There’s no doubt that the current state of the world and economy has led to unusual times for loan originators. Because of this, tips for loan officers help you stay on top of your mortgage business. Most loan officers have more business than they know what to do with right now! So, it’s important to be as efficient as possible.

Keep reading to learn tricks and tips for loan officers on ways to be more efficient in your daily work routine.

Tips for loan officers: Set up your space for success

Working remotely may be coming to an end for some mortgage teams. Whether you’re working remotely or in-office, creating a work-friendly space will help you in many ways.

Wondering how to make your workspace exciting and fresh? New decorations, motivational signs, inspirational quotes and personal touches go a long way.

Investing in good lighting can help to avoid eyestrain. Add plants around your desk for stress reduction, more oxygen, and ambiance. Put your work-ethic on display with slogans, goals, and motivation.

Keeping your office space organized will help you be more efficient. You will have no trouble finding the documents you need and reaching the right clients at the right time.

Consider your limitations

Capacity is about units, not volume. If you can only call a limited number of clients in the week, prioritize calling the easiest to qualify. Or, the highest volume. Rather than wondering who to call when, and focusing on tips for loan officers, consider following a daily schedule.

Create goals

What do you want your pipeline to look like in six months? How about one year?

Loan officer coaching, continuing your education through loan officer resources, and committing to a daily schedule are tips for loan officers. These are ways that loan officers can find success through self-improvement. Making a loan officer business plan isn’t all about the numbers: it’s also about investing in yourself through goal setting.

Decide what you would like out of your future. With a visualization of your ideal future self in mind, you can then begin to implement changes that will help you reach those goals. Since you have your goals in mind, you can decide how to span the gap between where you are now, and where you’d like to be.

Ask yourself, how can I reach my goals? What will I need to do differently? For example, perhaps you’d like to increase your loans closed per month from 5 to 10 in the next 2 years. Decide on how you will reach this goal, and write down those steps. Maybe you will increase your lead generation techniques by committing to a certain number of realtor partner meetings a week.

Whatever you decide to do differently, make sure that your goals are trackable and specific. Otherwise, you’ll never be able to tell if you’re truly hitting your benchmarks.

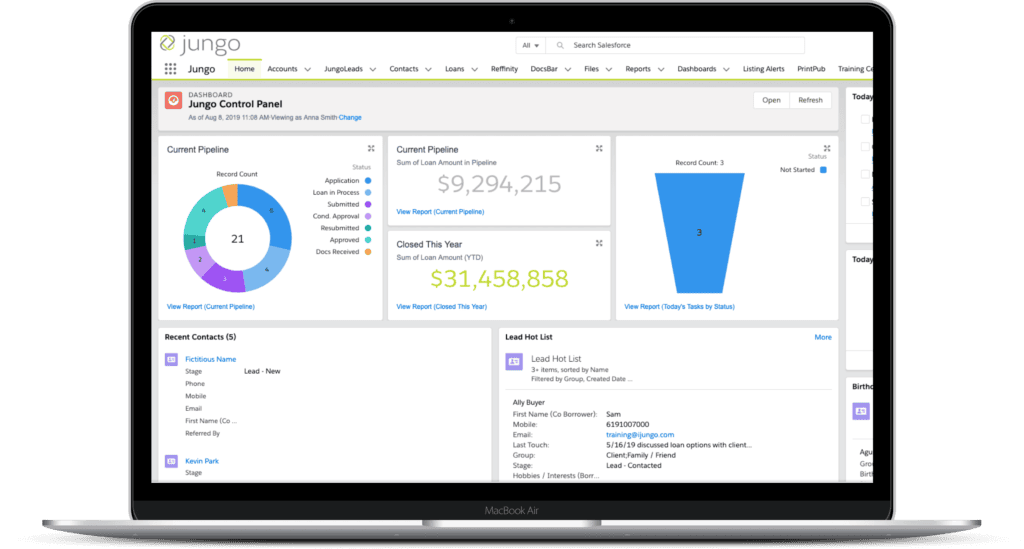

Check in on your loan officer business plan on a regular basis. Jungo fully embraces tracking progress. Since Jungo is fully customizable, you can set a goal like a certain number of realtor partner meetings a week. Then, measure those on your dashboard.

Time blocking

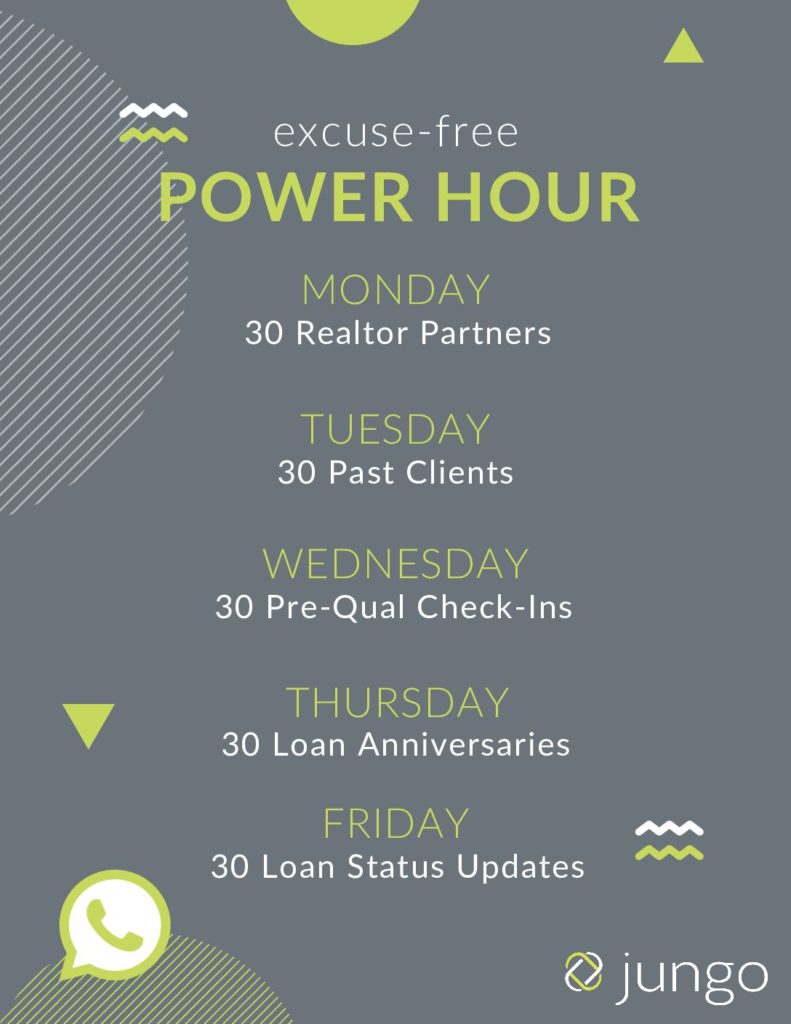

Loan officers and other professionals have been hearing about time blocking for a long time. However, time blocking goes way beyond scheduling your day around meetings, phone calls, or networking.

Using time blocking effectively can mean that your job can become a lifestyle business. You’ll be on your way to producing an epic amount of closed loans without you having your nose to the grindstone 24/7.

Time block the most important

Setting priorities is the first step to creating a successful daily, weekly, or monthly schedule as a LO. Place your #1 priorities into your schedule first.

Do you want to take time to watch your kids play soccer every Thursday evening from 5-7? Block off your schedule as if you have a meeting. After all, you actually do already have a commitment to maintain. Doing so allows you to focus, instead of trying to juggle multiple personal and professional commitments at the same time.

Part of this first step is remembering to stay committed to the task you assigned yourself. After all, studies show that we’re about 40% less efficient when we multitask. So, when you’re watching your kid score their first goal, you should not be on the phone with a referral partner. Designate times in your day to focus on family and personal life.

Time block space to rest

Pert of being the best loan officer or branch manager is found in consistency. That consistency can only come if you’re not getting burned out by an overloaded schedule. For many, taking vacations can feel impossible. Or when they are on vacation, they’re not truly off the clock.

Not only is this a bad idea because of how ineffective multitasking is, it also defeats the point of taking time off. Rest!

How do you truly stick to your “out of office” email reply? Maybe it means bringing support staff onto your team to take some of the straightforward daily tasks off your plate. Or, it may mean talking with your referral partners about your desire for a better work/life balance. Brainstorm ways that you can continue to serve them effectively without them providing immediate replies all the time.

Time block the education

Now matter how long you’ve been in business, there is still so much to learn. Choosing to prioritize education could mean listening to podcasts about the industry on your commute. Or, choose one or two high quality newsletters that will fill your inbox with value (not spam!).

Making time for your education and improvement may also mean investing in a mortgage coaching program. Read more about some of the different mortgage coaching programs available here which provide tips for loan officers.

Use your software

Save time and let your software work for you with automated processes and marketing. Jungo allows you to automate many steps in the loan process that would otherwise be very time-consuming. Making your software stack work for you means less time-consuming and mundane tasks cluttering up your schedule. And this means more time to do the things you actually want to be doing.

Below is a list of some of the incredible mortgage automations found in the Jungo tool kit, their purpose, and how to apply them. These are all tips for loan officers.

Marketing campaigns

These are time-dependent marketing mortgage automations that slowly drip marketing to your leads or clients on a regular basis. They are perfect for keeping your clients focused on the goal of closing their loan or refinancing with you. They also change automatically based on your client’s stage with you: lead, in process, or closed.

Drip marketing is not exclusive to clients! There are also campaigns for realtors and CPAs to promote client referrals and good partnerships. It is important to have constant marketing going so that you are keeping your business in the forefront of your clients and partners minds

Reffinity

If you haven’t started utilizing Reffinity’s automations, you are missing out. Reffinity reports automate to send weekly reports to your most important realtor partners. This consistent update is a plus for your partners, and guarantees they are always in the know.

Reffinity reports can automate to send weekly for up to 5 years. They will include a list of all your referrals from this partner in your pipeline, as well as your last interactions you had with their clients.

Loan process checklist

With automated loan process updates, as soon as a loan moves to a new stage, updates are sent to your borrower and any relevant partners. Once these automate, you can focus on high-income opportunities like connecting with new clients and partners. Plus, your borrowers love the quick and consistent updates on the status of their mortgage.

Reports

Keep yourself up-to-date with reports that get sent to you automatically every week as your pipeline changes and grows. Pick some useful reports, like a “pipeline report,” “closed reports this week,” or an “activity report” that show all the closed tasks and calls from that week. Then, simply set up the report to email to you every week. That way, you can always check-in on your account.

Consider hiring a LOA

If you’re closing 3 to 5 or more loans a month, you may realize that you have a problem: there’s only one of you. It may be time to hire a Loan Officer Assistant (LOA), and take full advantage of the opportunities you have in the mortgage market. There are many tips for loan officers like this.

Hiring employees to grow your mortgage business may feel counterintuitive. More people means more overhead, right? Even though that is true, more of the right people will also mean more money earned.

Scenarios where a LOA can help

For instance, what if you didn’t have to spend hours every week gathering applicant’s documents? With your LOA completing that ongoing task, you would have more time to meet with realtor partners or focus on your lead generation tactics.

Many of the duties assigned to LOAs are repetitive, and easily learned, which means that you shouldn’t be dedicating your time and energy to them. With your focus on high value tasks, your loan volume will grow, and you’ll have the processing backend workflows in place to handle the scale.

Hiring to better work/life balance

Additionally, if you’re interested in finding a healthier work/life balance, bringing on help is critical. A LOA can allow an overloaded LO to take a small step back, and redirect their focus to other priorities. Ideally, you should be trying to work 40 hours or less a week. If that idea seems laughable at this point, it’s probably time to consider hiring a loan officer assistant.

Bottom line

Maintaining these tips for loan officers will help you be more efficient in your daily tasks. These time management decisions mean that your priorities will be set before all of the stresses of the day begin. Plus, it is easier to say no to unproductive tasks when you have a successful work environment and schedule supporting you!