When it comes right down to it, mortgages are all about money. How much will it cost for a borrower to buy a home? What will they pay in interest? How much will their monthly payment be?

Borrowers want a great deal on their mortgage, but they also want a great experience. And a huge part of crafting an amazing mortgage experience is transparently providing borrowers accurate pricing and processing borrower information in a timely fashion.

The Mortgage Industry is Changing

As the use of technology and automation rise, the mortgage process is not left untouched. In fact, loan officers are facing all the challenges and rewards that come with an entire industry shifting at its foundations. One of the most noticeable changes is the growing use of software to run the loan application process.

A Product Pricing & Engine (PPE) is one such platform. We’re fully aware of how important this is for the borrower and mortgage loan officer relationship.

In this article, we’ll discuss:

So, what’s a PPE?

A Product & Pricing Engine (PPE) allows loan origination teams to aggregate their company’s approved lenders and then calculate mortgage pricing options in real-time. With a PPE, loan officers can quickly calculate the best pricing options for their borrowers and update them instantly. Accurate and timely pricing helps borrowers quickly make a decision to use a loan officer for their mortgage.

A mortgage pricing engine software gives you the ability to provide an extra level of transparency and clarity to your customers. It will also help you to stand out from your competition when you can provide borrower pricing quickly.

However, with all these “new” technologies available to the mortgage industry, it’s important to prevent technology login fatigue.

How do you prevent technology login fatigue?

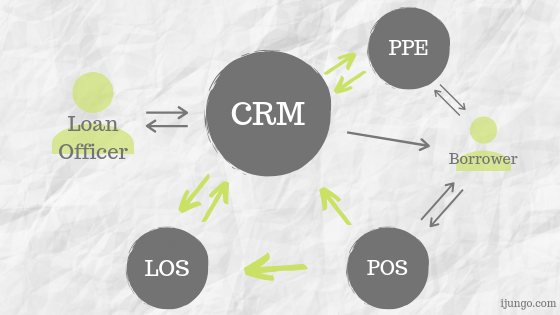

Many PPEs can integrate directly with your preexisting mortgage software platforms, like a CRM, LOS, or POS. Just keep in mind, though, not all “integrations” are created equal.

In short, native integrations, will give you full functionality within the platform you are using. For instance, Jungo’s PPE integration allows the user to create quick and full rate quotes from their mortgage pricing engine from within Jungo. So, it’s not just a data sync, but a full native integration.

What are the best PPE platforms?

When it comes time to choose a PPE, there are many different options. Here’s a brief overview of four of the most popular PPE platforms for the mortgage industry:

Optimal Blue:

Optimal Blue is the current industry leader in the PPE environment. They offer in-depth reports that show a comparison between current pricing, worst case scenarios, and historical averages.

Mortech:

Mortech’s PPE features a fully automated and accurate pricing engine, and a tool for comparing multiple loan scenarios. Plus, you can use a tool that allows you to view hundreds of investors’ rate data, all on a single screen.

Lender Price:

Lender Price offers pricing on all mortgage types, including conforming, non-conforming, non-QM, and speciality loans. This features could be especially helpful to loan officers who work with less traditional borrowers. They also offer built in compliance checks and capital market tools.

OpenClose:

OpenClose’s DecisionAssist is an Integrated Loan PPE that allows loan officers to instantly determine a borrower’s eligibility. Loan officers can also create professionally branded customer-facing web portals. Partners can use these to make decisions about loans, store documents, and manage pipelines.

How does the Jungo PPE Integration work?

Jungo’s PPE integration means that you’ll have one less login to manage, since you can run your PPE’s Quick and Full quotes from right in Jungo and immediately email quotes to borrowers. All reports and communication details are automatically stored in the contact’s record so you can easily track a customer’s history. You can even set up rate alerts for prospective borrowers.

What Are Rate Alerts?

Rate Alerts are an excellent way to generate more volume with ReFi opportunities. Set a preferred rate for your buyer and get an alert once that rate is available. It’s that simple!

Why should you care about a CRM and PPE Integration?

Integrating your CRM and PPE means that you can stop keeping track of rate quotes, loans, conversations, marketing, and buyer’s preferences in disparate systems that do not “talk” to each other.

With Jungo + the PPE Integration, loan origination teams will only need one login to manage rate quotes, marketing, and workflows in real time. Speeding up your processes will get quotes into the hands of borrowers faster, which leads to more closed loans, and also greater customer satisfaction.

What some possible scenarios where Jungo’s PPE integration will help you?

For example, imagine you have a new borrower who is interested in applying for a loan. With Jungo integrated with your PPE, it’s simple to send borrowers all the information they need to make a decision.

You can send the borrower personalized, scenario-specific pricing that includes a variety of loan pricing options. Borrowers will appreciate the side-by-side comparisons of various types of loans.

After all, it can be difficult to fully understand how choosing between a 30-year fixed, 15-year fixed, or ARM mortgage will really affect you. But with pricing scenarios, your borrowers can truly see differences in interest rates, monthly payments, and other loan terms.

Mobile Optimization

Plus, pricing scenarios are mobile optimized. This means that borrowers, realtors, or any other interested parties, can easily view their loan options, even if they’re on-the-go.

What Does This Mean for You?

So, it’s clear why your borrower’s will appreciate the integration between your CRM and PPE, but what about you? Well, thanks to the seamless interaction between Jungo and your PPE, you no longer have to worry about sending inaccurate pricing options or spending way too much time putting it together.

And thanks to your pricing engine being integrated with your CRM, you only need one login for your entire to-do list. Being able to send pricing options to borrowers straight from your CRM will give you more time to close loans.

Plus, since the two platforms are seamlessly integrated, all PPE reports and communication details are automatically tracked and attached to your Contact Records within Jungo.

You’ll also be able to initiate follow-up marketing to new borrowers with a single click, which will trigger one of Jungo’s built-in email marketing campaigns.

Bottom Line

Not only does Jungo’s PPE integration provide a fast and effective solution for you, your borrower’s will love it.

If you want to learn more about Jungo and the PPE integration, click here.