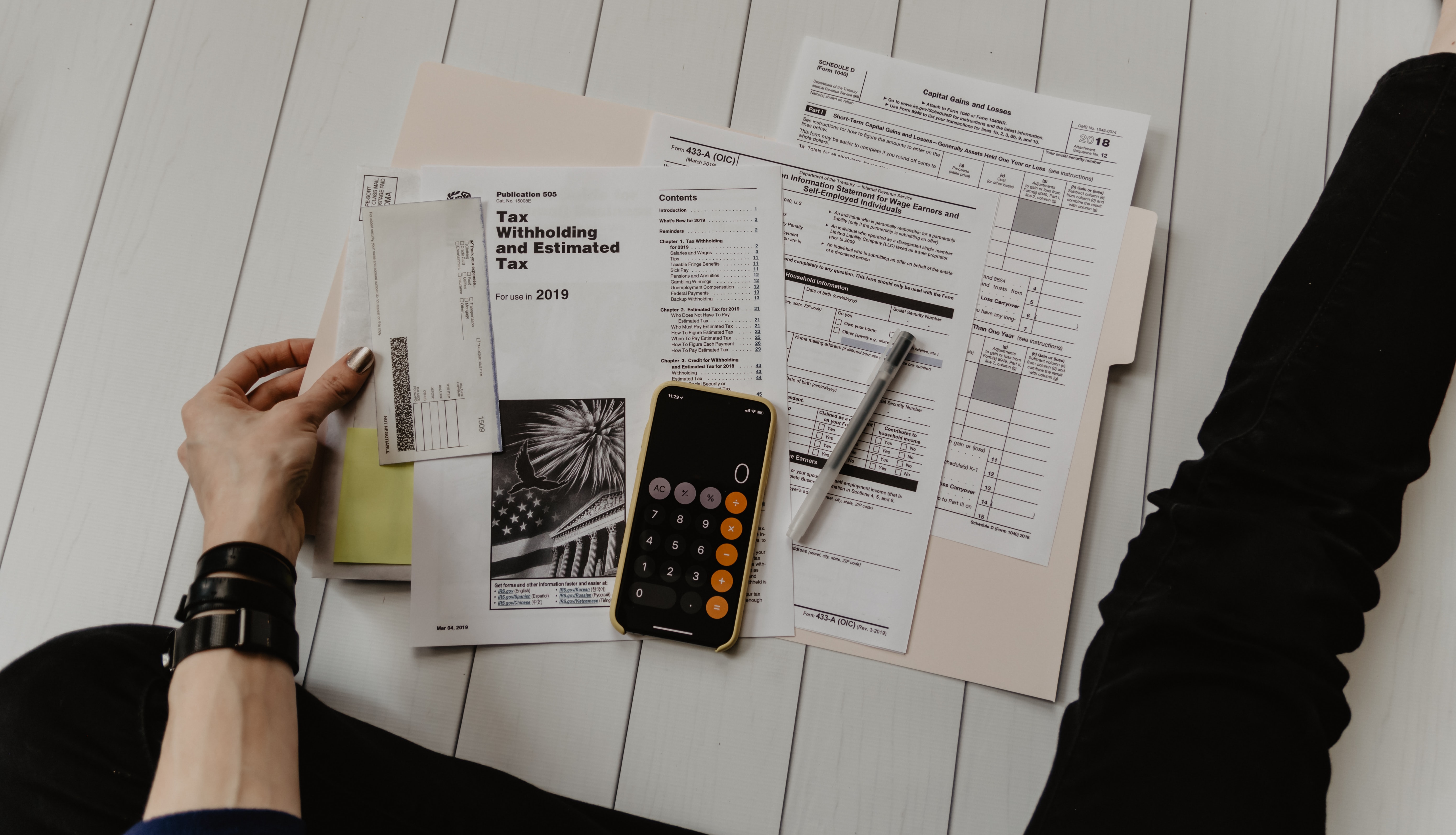

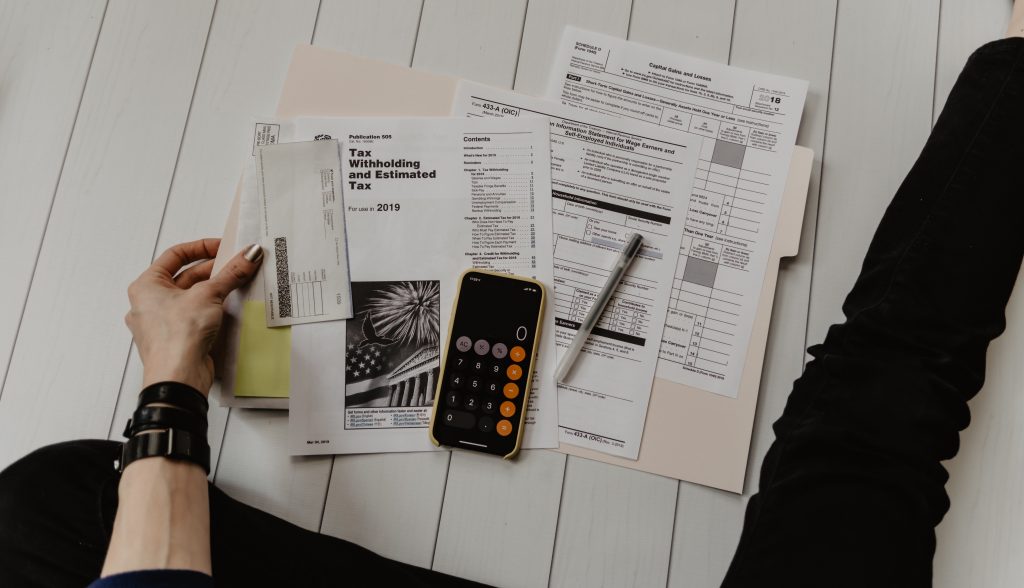

Homeownership can come with benefits and tax perks. Also, there are many tax benefits for new homeowners to look forward to, but some are not as obvious as others. So, educate your borrowers with homeownership and tax tips that lead them to financial success!

Free, Shareable Resources For Borrowers

The Mortgage Update is a free, shareable resource that you can send to customers.

After all, it is your job as a loan officer to be your client’s guide. So, make sure your borrowers know that they are not alone.

So, share this borrower-friendly blog post with clients to help them understand tax perks that come along with purchasing a home. Also, consider posting this on social media to interact with your customers in a more personal way.

So, share this borrower-friendly blog post with clients to help them understand crucial tips for selling a house, one of their biggest investments. Also, consider posting this on social media to interact with your customers in a more personal way.

Read the Article on Tax Perks Now:

Bottom Line

Owning a home can be expensive, but fortunately, the tax perks can help make up for the extra costs. Also, homeowners need to know which deductions and credits they qualify for. So, as a loan officer, make sure your clients maximize their benefits and are aware of what tax perks they can take advantage of.