Mortgage lead follow-up best practices are all about time and consistency. So, you may be asking, what is the best time and way to reach out and contact clients?

The most successful mortgage professionals prioritize lead follow-up and try to contact fresh leads as soon as possible. The longer the lead waits around, the colder they get.

After this initial conversation, the next stage of follow-up correspondence then occurs. After all, consistency in following up with leads is more important than getting the leads in the first place. No matter how many fresh leads you generate, if you’re not properly following up, and ultimately converting them into clients, you’re wasting your time.

Keep reading to learn day-by-day lead follow-up best practices!

Why Pursue Lead Follow-Up Best Practices?

It is said that the more you follow-up with leads, the more you will convert those leads into customers. In a study of mortgage companies and their follow-up practices conducted by TenFold.com, it confirms that sales improve with a strategic follow-up strategy.

A mortgage officer can see that following up with leads via email, alongside the traditional phone calls, produces positive results. These results outperform the lenders who rely on phone calls exclusively.

So, when it comes to following up on mortgage leads, contact needs to be made immediately, consistently, and via multiple channels. Remember: this is a game of persistence. The lender who pursues their leads with lead follow-up best practices will enjoy greater sales results.

Gather Lead Contact Info

It is necessary to have as much information about your leads as possible. There are several ways to receive leads, such as buying them, generating them organically, or both. So, think beyond just their basic information.

Also, if the lead came through a referral, you’ll have a better chance of having more personal data. So, gather their email address and zip code. In some circumstances, you can even brainstorm talking points before reaching out to them. Be sure to ask the right questions once you receive a referral!

For example, if a new lead is coming to you from a referral partner, consider asking the partner for any details they have on the lead. Are they a new homebuyer? Are they looking for refinance information? What are their financial goals?

These guiding questions will help you to personalize your lead follow-up right away, which will earn you even more clients.

Enter Leads Into Your Database

Don’t forget this often overlooked step! Even though your lead isn’t a borrower quite yet, you still should put them into your customer relationship management system (CRM). Entering them into your database simplifies the follow-up process. Also, it increases your chance for successful conversion.

Consider looking for a CRM that allows you to track calls, texts, and other touchpoints that you have with your contacts. Plus, a powerful CRM will allow you to easily transition a contact from lead, to borrower, to past customer after they close, and easily market to them at every stage. These status changes will trigger automated workflows, prompting you to follow-up exactly when you need to.

Create a Game Plan

Once you know who you need to reach out to, determine how to approach them. Some loan officers like to call as soon as they get a lead’s information, which can be helpful. This method works because leads are more likely to convert the sooner they are called.

However, this isn’t the only way to approach nurturing a lead. So, you could choose to send an introductory email or text, and then call after. When deciding how you would like to approach new leads, consider what has worked well for you in the past.

Put It Into Action!

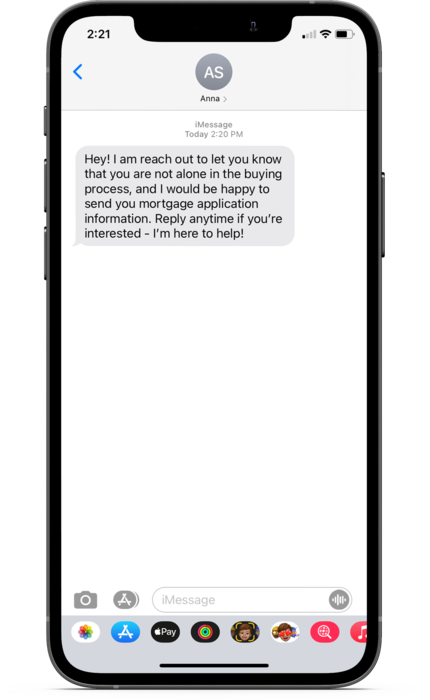

For example, if you decide to reach out with a text first, you could send something like this:

Hey there [FIRST NAME], I am reaching out to let you know that you are not alone in the buying process, and I would be happy to send you mortgage information. Reply back if you are interested. I’m here to help!

Also, consider the type of lead. Your conversion strategy may change depending on if your lead was a referral, purchased, or found through online marketing. You may find that for cold leads (prospective clients who did not reach out to you first), it’s most effective to focus on email marketing until they have been “warmed up.”

Have Talking Points

So, once you do get a lead on the phone, what will you say? Before you give them a call, look them up with a quick internet search or in your CRM if they are already in your database. Is their birthday coming up? Do they live in an area that you have visited? Find personal points to touch on.

Also, introduce a personal touch to your communication. Don’t use strict scripts for your calls! Instead, lay out general talking points to guide your conversation. Prove that there is a caring human behind the phone. It’s more important than ever to create an emotional connection with the lead.

Begin With a Phone Call

When you do end up picking up the phone to call your newest lead, think ahead of time what you’d like to say. Here are a few things that you could consider putting into your initial phone call plan: a brief introduction, a few questions about their mortgage needs, and an invitation to contact you if they would like more information.

Put It Into Action!

Here’s an example:

“Hi, this is _________ and I’m from ___________. We have a great informational event coming up next week that would help you purchase your dream home successfully. Call me back for more information and we can get you started on your mortgage journey! Thank you and have a wonderful day!”

Don’t forget to include a brief heads-up at the end of your call that you will follow up. Of course, thank them for their time! Making your leads feel valuable and cared about is key to a high conversion rate.

Send Emails

Email marketing is a very cost effective way to engage leads. It also helps you stay in contact with current and past borrowers, which can lead to possible refinances or new mortgages.

Your initial lead interest emails should showcase who you are and the services you provide. So, keep your marketing emails short and to the point. Then, be sure to include an invitation for the recipient to contact you to get more information if they are interested.

Not only will these initial emails keep your prospective client’s attention, they lead to productive conversions. Your email may then trigger a returned email or even better, a phone call. Then, you have a much better chance of converting leads into borrowers with lead-follow-up-best-practices.

Drip Email Marketing

Once you send an initial lead interest email, keep the conversation going. Drip marketing email campaigns are one of the best and easiest ways to reach potential, current, and past customers. Also, sending your closed clients emails regularly is a great way to ensure that you stay at their top of their minds.

If you do not have time to create your own campaigns, utilize a mortgage marketing service like Jungo. Jungo’s post-closing marketing email campaigns drip to your closed customers, once a month for up to two years.

Some email drip campaigns and mass emails to consider implementing are: holiday emails, industry updates, prospective home buyer tips, keeping in touch with past customers, and tips and tricks for loan applications. Automated campaigns such as this are a great way to ensure that you’re the first person your borrower thinks of when they have any mortgage needs.

Repeat the Process

Once you’ve made your initial touch, it’s time to do another follow-up. It takes an average of 6-8 contact attempts to qualify a lead. However, the average salesperson follows up with a lead less than twice. So, there is room for opportunity with lead follow-up best practices!

The fact is, the closer to the time of their inquiry you can get in touch with them, the more likely you are to qualify and convert them. One of the foundational principles of successful lead conversion is endurance. Exactly how many times you choose to contact a new lead is up to you. However, successfully converting a mortgage lead to a loan applicant will probably take longer than you think.

Put It Into Action!

An example of day-to-day follow-ups may look like:

Day 1: Call x2, Text x1, Email x1

Day 2: Call x2, Text x1, Email x1

Days 3-10: Call x1, Text x1, Email x1

It can be difficult to walk the fine line between being persistent and being intrusive. When deciding how long to wait between contact attempts, think about how you’d like to be treated as a customer.

Track Interactions

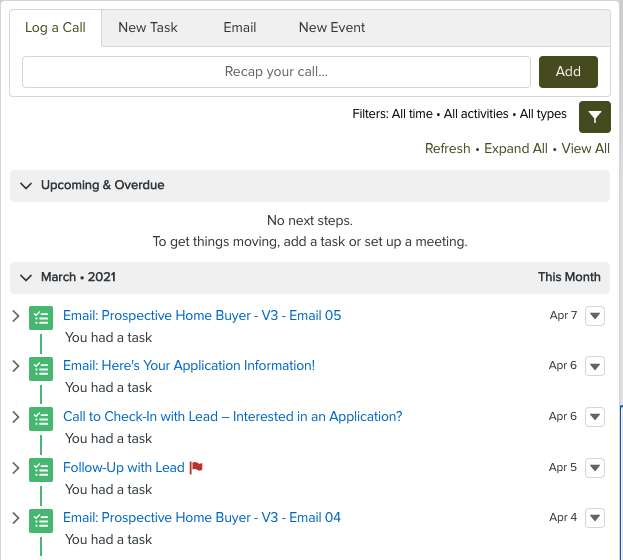

As you contact a lead, it’s important to track all your attempts to convert them. You could use a simple Excel sheet or even a Word document to track this activity. However, this is another area where a powerful CRM can really come in handy as a way to leverage lead follow-up best practices.

As soon as you get off the phone with a lead, or send an email or text to them, log the interaction! This is one of the best ways to earn customers. With this method of tracking touches, you can note when you spoke with them, and what your interaction consisted of. Then, next time you connect with them, you know exactly where you left off in your conversation.

Jungo’s Contact Interaction Tool

Bottom Line

As difficult as it can be to implement lead follow-up best practices, the most important thing is to stick with your plan. So, incorporate these steps as part of your long term strategy.

You probably won’t see incredible ROI immediately, but don’t get discouraged. Continue to call, email, and text new leads. Keep logging your interactions. Find ways to offer value and advice to potential customers. Then, you’ll begin to see higher rates of conversion, and therefore, more loans in your pipeline thanks to lead follow-up best practices.