What is something every loan officer needs? A document management solution. Loan officers are familiar with an overwhelming amount of documents. There are many documents from borrowers to keep organized, including income, credit report, renter history, and more.

You receive documents in many forms. Some loan officers receive paperwork via email, fax, or even in-person drop-offs.

That means that you have to stay on top of many different document sources. Most items are virtual these days due to COVID-19. Jungo realizes that having to find, scan, and email paperwork is not ideal. A document management solution is needed.

More documents means more loans getting closed. Staying on top of these is a full-time job in itself. Luckily, there are programs out there to help you as a document management solution! Mortgage document management is made easier and less time consuming.

That is where the Jungo DocsBar comes in!

Jungo’s DocsBar

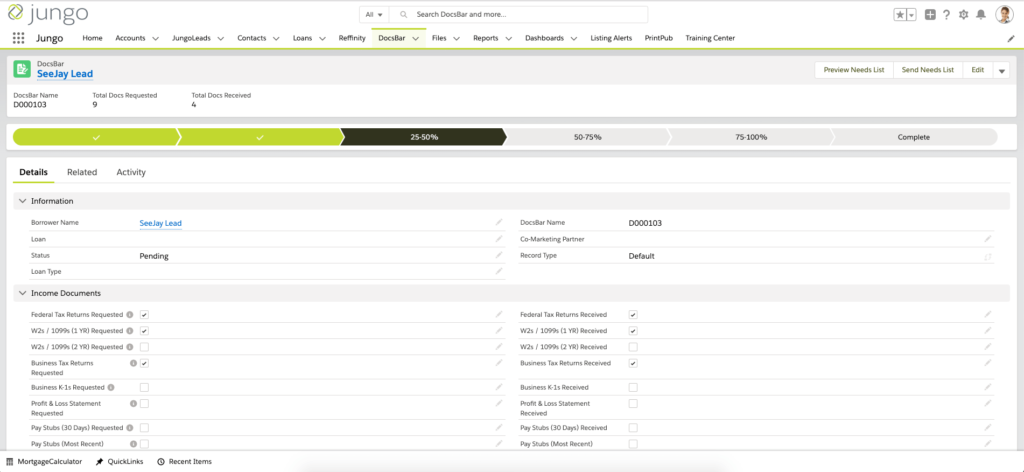

DocsBar is Jungo’s mortgage document management solution. It is a custom system created by the Jungo team in your account. Also, it is a needs list generator meant to help you shave time off the loan process.

So, you can focus on those new leads coming in and closing loans as quickly as possible. DocsBar allows you to track the progress of your borrower’s applications.

A Floify integration for DocsBar is also available, so it saves you even more time and automates everything a bit further.

DocsBar Default Feature

In the DocsBar default, you can request and receive items. There are checkboxes for your items which you can use as your document management solution.

The sections include income documents, asset documents, property, and home history documents.

Also, they’re all organized and easy-to-access for you and your client when the needs list goes out. This saves you time and headaches. Plus, your borrowers appreciate knowing exactly what they need to send you and when.

It includes the name of the documentation and a brief description of each of these documents for your clients to understand. So, this allows you to teach them about the home buying process along the way!

Organizing your documents this way sends an email to your borrowers with their initial needs list. The DocsBar path along the top, the progress tracker, updates to reflect the percentage of items you receive. It’s that easy!

Custom Email Templates

When you want to remind your borrowers about the documents they still need to send, you send out an updated needs list. You can easily go in and make edits to the Jungo default email templates. So, this allows you to add links, logos, and customized wording.

Make those changes exactly how you’d like. Also, once you create these personal changes within DocsBar, every email will replicate it.

Jungo + Floify Integration

The DocsBar default is a huge timesaver for sending needs lists. So, that’s a lot less emails that you’ll have to go in and create.

To take it a step further, DocsBar has a Floify integration. If you want to add the Floify integration, we’d be happy to help!

When a borrower starts a loan application with you, all you do is click a button in Jungo to start a loan flow. Also, Floify sends you update emails and allows you to automate several tasks.

It is really easy to push your contacts into your Floify pipeline. You log into Floify to accept or reject the documents sent to you. This lets you see how many items are requests from your quick pack, which is your default needs list. Also, it shows what is pending review and what has been accepted.

Floify automatically sends out emails for you when items are still missing. So, you can spend less time chasing down documents.

The way Floify and Jungo work together saves you time and, in turn, makes you more money. So, you’re able to spend that time calling your leads and closing clients.

Bottom Line

Online mortgage document management portals are a great solution to saving time, pleasing your borrowers, and increasing your business security. So, consider a platform that saves you valuable time and makes your client experience better.

Using a CRM that integrates with a client facing document portal checks many boxes to help your business run smoothly, and successfully!