Mortgage POS (Point of Sale) systems bring all the best together: efficient loan processing, automation, and a transparent and accurate experience for your borrowers.

When it comes to the software you need to succeed as a loan officer, you are probably already very familiar with using a Loan Origination Software (LOS) or even a CRM, like Jungo. Both are invaluable to increasing efficiency, as well as utilizing best practices to your fullest advantage. But mortgage POS systems may not be quite as familiar. If so, you’re missing out on everything they have to offer.

What is a mortgage point-of-sale (POS) system?

In short, it’s a digital loan application as well as a portal for your borrowers to upload necessary documents, and track their loan through the process for themselves.

If you’re in the market for a POS system, shop around, like you would for any product or service. Be aware that every platform offers slightly different tools.

What do Mortgage POS systems do?

Even though each POS has different capabilities, there are a few major features to look for. Digital applications are a large part of most POS platforms, since more and more borrowers are looking for an easy entry into the loan process.

Additionally, many POS systems feature document management tools, giving borrowers the ability to submit necessary loan documents directly.

When considering the different POS systems available to loan origination teams, we considered a number of factors. These included features, ease of use, and price, as well as customer reviews when they were available.

Top Mortgage POS Systems:

1. Floify

2. Blend

3. Loanzify

4. CloudVirga

5. Maxwell

6. MortgageHippo

7. Roostify

8. BeSmartee

So, let’s get into what makes each of these POS platforms great!

Floify

You may know Floify for its abilities as a document management system, but this POS does much more. They also offer electronic applications, credit reporting, and pipeline management. Online customer reviews indicate that there is a great amount of customization available, and that it has increased efficiency in the loan process.

Floify Features:

- Digital 1003 loan application

- Secure document portal

- Automated borrower and agent notification platform

How much does Floify cost?

Unlike many other POS systems, Floify’s website does list pricing, and it indicates that their plans start at $49 per month.

What platforms does Floify integrate with?

Floify integrates with most major mortgage software platforms, including, Jungo, Encompass by EllieMae, Dropbox, Docusign, Byte, and Optimal Blue.

Seeking Better Lending extends beyond just POS platform Blend’s name. Hence, Blend focuses on creating streamlined digital applications for your borrowers and decreasing the days needed to process a loan. They also help to automate processing steps that could lead to delays or mistakes. According to Blend’s website, customers who start an application in Blend have an 89% submit rate–that’s an industry best.

Features:

- Guided workflows help borrowers work through digital application

- Tools to make loan origination efficient

- Automated follow-ups

How much does Blend cost?

The Blend website says that the program’s price is per loan, but they do not indicate what that cost is.

What platforms does Blend integrate with?

Blend integrates with Jungo, Encompass by EllieMae, Optimal Blue, Fannie Mae, Equifax, Plaid, and more.

Loanzify is LenderHomePage’s app, which allows users to calculate monthly payments and refinance scenarios, submit documents, and sign closing documents. Plus, loan officers can customize the app with personalized color schemes, logos, and content.

Finally, reviewers seem to love the mortgage calculator options as well as its ability to scan and upload documents directly. Loanzify also has an option for Enterprise clients, with multi-branch support and a custom app name and icon.

Loanzify Features:

- Calculate monthly mortgage payments and refinance scenarios

- Document submission portal with the ability to scan directly from mobile phone

- Closing documents review

How much does Loanzify cost?

Loanzify offers a Basic and a Deluxe pricing option, with slightly different tools available in each. The Basic plan is $19.95 a month, while the Deluxe plan is $29.95 a month.

What platforms does Loanzify integrate with?

Loanzify integrates with all major third party LOS applications including Calyx Point, Encompass by EllieMae, PC Lender, and LendingQB.

In addition to the normal mortgage POS system offerings (digital applications and document uploads), Cloudvirga’s Mobile POS also allows smooth collaboration between interested parties. Borrowers, realtors, and builders, can all communicate using chat and email.

There aren’t very many reviews of Cloudvirga, but customers do seem to appreciate the easy-to-use interface.

CloudVirga Features:

- Borrowers can check their loan details, documents, and milestones

- In-application chat for instant communication

- Customized interface to suit a borrower’s or loan officer’s style

How much does Cloudvirga cost?

Cloudvirga’s website does not list pricing. But according to HousingWire, “a case study by a Top 10 lender showed that CloudVirga’s POS platform reduces mortgage origination costs by $1,500 per loan,” which could justify the cost of their service.

What platforms does Cloudvirga integrate with?

Cloudvirga integrates with Optimal Blue, Encompass, Docutech, and more.

Last but not least, as a two-time winner of HousingWire’s Tech100 Award, Maxwell wants to create technology to help borrowers, not make them faceless numbers. According to their website, their mortgage POS system helps lenders close 45% faster than the national average.

Maxwell Features:

- Digital document collection

- Custom task lists and due dates get loans submitted faster

- Syncing with thousands of financial institutions so borrowers can import their bank statements and paystubs instantly

How much does Maxwell cost?

Maxwell offers three pricing options: the Starter plan is $139 per month, the Professional plan is $159 per month, and the Enterprise plan does not have pricing on their website.

What platforms does Maxwell integrate with?

Maxwell integrates with Encompass by EllieMae, LendingQB, Optimal Blue, Docutech, Docusign, and many other partners.

MortgageHippo

MortgageHippo believes that the best digital lending platform is one you can make your own. That’s why their POS is customizable and allows you to adapt workflows and processes. Plus, they offer personalized LO landing pages to capture more referrals. These can feature a digital application, loan or refinance calculator, and even videos from the LO.

Features:

- Borrower facing loan dashboard that guides them through the application process

- Document manager and e-signature portal

- Lender facing portal to access borrower’s files and communicate with them

How much does MortgageHippo cost?

MortgageHippo does not list their pricing on their website.

What platforms does MortgageHippo integrate with?

MortgageHippo integrates with Byte, LendingQB, MortgageFlex, Encompass by EllieMae, Optimal Blue, Mortech, and many others.

Roostify

Next, Roostify says that their system is more than a Mortgage POS, it’s a Digital Mortgage Platform that moves mortgages forward. They also say that their platform increases margins and makes the loan process more productive and faster.

Features:

- Optimized digital user experience with intuitive customer-friendly interface

- Personalized branding for a customer-friendly experience

- Adaptable workflow and configurable experience

How much does Roostify cost?

Although Roostify does not list their pricing on their website, free demos can be requested online.

What platforms does Roostify integrate with?

Roostify integrates with Encompass by EllieMae, Mortgage Cadence, Black Knight, Salesforce, Velocify, OptimalBlue, and more.

BeSmartee

With a friendly online loan application that uses big data and pre-population, BeSmartee says that borrowers go from application to appraisal in minutes. Borrowers can also access Product & Pricing (PPE) from within BeSmartee, which shows that real-time and accurate pricing options.

Features:

- Collaboration tools for direct communication with all parties involved

- Automatic data and employment validation

- Automated underwriting is triggered throughout workflows

How much does BeSmartee cost?

Even though BeSmartee doesn’t list their product pricing on their website, they do break down their plan options. With three different options ranging from BeSimple, to BeAutomated, to BeSmart, it appears that they have a price point and platform for every type of LO and team.

What platforms does BeSmartee integrate with?

BeSmartee does not identify specific software systems that they integrate with, but they do offer LOS integration and syncing, as well as integrations with PPE platforms and Fannie Mae.

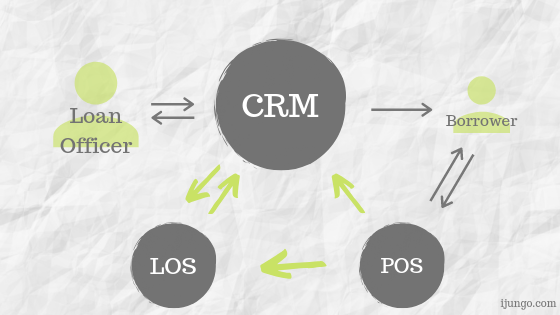

How do a POS, LOS, and CRM work together?

If the talk of all these different software platforms makes your head spin a little bit, keep this one simple fact in mind. When your CRM is at the very center of your software stack ecosystem, you’ll reduce login fatigue.

A good CRM will integrate with your other mortgage software systems, allowing you to communicate and utilize the programs, all from within your CRM.

What does a POS and CRM integration look like?

Some of the communication paths between mortgage software applications could look like this: a loan officer can communicate with the borrower through the CRM, as well as see all their loans and transactions. Also, within the CRM, the LO can also see the leads that didn’t complete an application while the borrower was using the POS.

The POS can also push data and completed applications to the LOS, which automatically syncs with the CRM. So, with a Mortgage CRM, like Jungo, a loan officer only has to login once to manage all their software systems and interactions with borrowers, partners, and more.

Use this handy infographic to visualize the way all the software platforms work together.

How much does a Mortgage POS cost?

You will most likely spend between $20 and $160 a month on your POS, so shop around and find the price point and features that works best for you. Remember, choosing a Mortgage POS platform is like any business purchase–it is an investment.

Bottom Line

There’s no doubt that loan officers’ days are becoming more and more technology-driven, and we say, thank goodness! You are busy enough without the extra time required to also deal with unnecessary paperwork and tasks that could be automated.

However, if you choose solutions that do not talk to each other with native integrations, you won’t end up saving much time. You’ll just shift your energy from pushing paperwork to doing double data entry between all the systems.

So, be sure to find a mortgage POS solution that will talk to your CRM and LOS. Instead of filling your day entering data, you’ll be coming up with creative solutions to close more loans.

Lastly, a mortgage POS system should be a resource for your team. One that also allows you to delight your borrowers with efficiency and transparency.