Chapter 1

What Is Mortgage Marketing?

Chapter 2

Loan Officer Marketing Plan Template

Chapter 3

Effective Digital Mortgage Marketing Strategies

What Is Digital Mortgage Marketing?

Why Is Digital Marketing Important?

How To Get Started in Digital Mortgage Marketing

Digital Marketing Strategies for MLOs

Chapter 4

Loan Officer & Mortgage Broker SEO Strategies

Chapter 5

Loan Officer Marketing to Realtors

Many mortgage borrowers begin their journey online, using the internet to gather information and compare their options before ever speaking to a mortgage broker or lender. The increased use of online search has made digital mortgage marketing a critical part of any successful mortgage broker’s marketing plan.

In this chapter of our Mortgage Marketing Guide, we will:

- Discuss the importance of incorporating digital marketing strategies in your mortgage marketing plan

- Identify three critical questions to ask before developing your digital marketing strategy

- Explore four top digital marketing strategies to drive new business and engage your clients throughout their client journey

If you’re looking for ways to optimize your online and social presence, you’re in the right place. Keep reading to learn more.

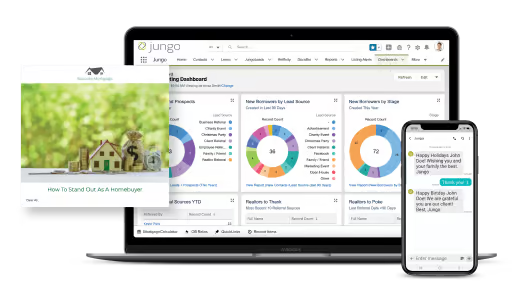

What Is Digital Mortgage Marketing?

Digital mortgage marketing refers to all promotional efforts to connect with prospective mortgage clients through digital channels. It typically involves using a variety of channels, including your website, search engines, email, SMS marketing, and social media, to reach potential borrowers. Since so many people spend their time online, digital marketing is integral to any successful loan officer marketing plan.

Why Is Digital Marketing Important?

Digital marketing for mortgage brokers is essential because it provides an efficient method for bringing in purchase business and developing relationships with realtors. Automating your digital marketing strategies can help you save time and focus on revenue-generating activities, like meeting with borrowers and processing loans.

A solid digital marketing strategy also helps keep clients informed and engaged, allowing you to continue nurturing the relationship long after the loan closing easily. Ultimately, this can generate more referrals and repeat business.

How Do You Get Started In Digital Mortgage Marketing?

Digital marketing is not something you will master overnight. Start slow. Below are a few essential questions to ask before developing your digital mortgage marketing strategy:

1. Who Is My Target Audience?

One of the most significant advantages of implementing a digital marketing strategy is the ability to reach your target audience precisely. Define what your ideal client looks like, their needs, how your services can solve those needs, and what value you can offer to differentiate yourself from competitors. For example, do you specialize in VHA loans, cash-out refinances, or another specialty? Think about the unique needs of a client seeking these types of loans and how you can address them. Lastly, consider the geographic location of your target audience and localize your communications as much as possible.

2. What Channels Can I Use To Reach My Target Audience?

Now that you know who your ideal client is, put yourself in their shoes:

- Research your ideal client’s behaviors – Where do your clients go when seeking information? Do they search online? Do they ask their friends? Understanding your target audience’s habits will help you reach them at every stage of the mortgage marketing process, from the prospect stage to post-close.

- Use your current customer base – Gather information from current and past clients to create a template of a typical customer journey and identify crucial touchpoints where you can nurture a lead, provide value to an existing client, or reach out to ask for a referral. Ask your clients about their experience with your mortgage firm. What did they like throughout the prospect stage that led them to choose you over your competitors? Was there a moment during the in-prospect stage that made them glad they chose you? Qualitative feedback is useful for shaping your brand messaging and continually improving your client interactions.

- Research your competitors – You’re not the only one targeting your ideal client, be sure to conduct first-hand research on all the alternatives your clients might encounter while searching for a mortgage broker. Analyze your competitors’ marketing efforts and determine whether you could achieve results using the same methods.

Lastly, don’t forget to consider your budget. Depending on your marketing budget, you might find that some digital marketing strategies, such as SEO, content marketing, or email marketing, are more cost-effective than paid ad campaigns that you can carry out on Pay-Per-Click (PPC) platforms. Make sure to measure the Return On Investment (ROI) of your campaigns to make informed budget decisions and maximize your marketing outcomes.

3. How Will I Measure the Success of My Digital Marketing Campaigns?

Once you’ve decided on the best digital marketing channels to reach your target audience, it’s time to establish Key Performance Indicators (KPIs) for your campaigns. Standard performance metrics include cost per lead, conversion rate, customer acquisition cost, and customer lifetime value. Keeping track of these metrics will help you monitor your campaigns, optimize them for better results, and determine where your budget is well-spent (and where it’s not). Once you answer these three essential questions, you are ready to create your digital marketing strategy. Focus on the digital marketing channels that give you the most significant ROI, and don’t feel you need to do everything at once! Start with one or two ideas, and go from there.

4 Digital Marketing Strategies for MLOs

There are various digital marketing strategies businesses can use to expand their reach. For mortgage marketers, some of the most effective options include email, social media, SMS texting, and video marketing. Here’s a closer look at how you can use these strategies to optimize your online presence and grow your mortgage business.

1. Mortgage Email Marketing

What Is Mortgage Email Marketing?

Mortgage email marketing is the process of using email to communicate with current and prospective clients. It’s an effective strategy for connecting with and educating individuals considering taking out a mortgage or refinancing their existing mortgage. According to OptInMonster, 59% of consumers say marketing emails influence their purchase decisions, and 80% of marketers believe email marketing increases customer retention.

Rather than sending customized emails one at a time, email marketing typically uses pre-made, professional-looking email templates that allow you to quickly reach clients and prospects with relevant information designed to appeal to a broader audience. This mass email marketing strategy will enable you to reach more people with less effort.

What Are the Benefits of Email Marketing for Loan Officers?

Email marketing offers many advantages for loan officers and other mortgage professionals. A loan officer can acquire a substantial database of customers through an email campaign. Additionally, the officer will be able to promote content related to how a mortgage loan works and what the reader can expect during the lending process.

Using email marketing to stay in touch with clients and prospects regularly also ensures they remain aware of the loan services you offer, even when the market is struggling. By varying the types of communications you send, you’ll be able to maintain contact without feeling like you are constantly pushing your services.

How to Get Started with Mortgage Email Marketing

Mortgage professionals often hesitate to start email marketing campaigns because they don’t have time to consistently write and create fresh content. Loan officers can easily automate their email marketing with a mortgage email marketing solution. Examples of mortgage email templates you can send include holiday emails, event invitations, and updates about industry and community news, in addition to your standard mortgage marketing newsletters.

As you plan out your email marketing strategy, remember that it’s important to send emails people want to read. Make your content relevant to your audience. 74% of consumers get frustrated when emails contain content that has nothing to do with them. These emails are likely to get lost in the inbox or immediately deleted. Keep your messages brief, make the content enjoyable, and experiment with different formats and various calls to action.

2. Social Media Mortgage Marketing

What Is Mortgage Social Media Marketing?

Social media marketing is a form of digital marketing that uses social media apps – like Facebook, Instagram, Twitter, and LinkedIn – to connect with an audience and build brand recognition. With 3.96 billion social media users across all platforms (and growing), social media marketing can no longer be ignored as a strategy to drive traffic to your website, build a community of followers who will engage with and share your content, and, ultimately, increase your sales.

What Are the Benefits of a Social Media Mortgage Marketing Strategy?

Social media is now integral to a business’s overall marketing strategy. Unfortunately, many businesses are missing key opportunities to see results from social media marketing because they don’t have a strategy. Your mortgage business has financial goals and plans to achieve them, and you should treat your social media presence the same way!

If you truly want results, it’s time to implement a social media strategy. An intentional strategy can help you build your brand, develop relationships, strengthen your fan base, and increase word-of-mouth advocacy.

To learn more, download Jungo’s free e-book, The Art of Social Media for Loan Officers, which drives loan officers to social media success with specific examples and tips and tricks.

Top Social Media Platforms for LOs and Mortgage Brokers

One of the keys to mastering social media marketing is choosing the right platforms. Here’s a look at some of the top platforms most effective for loan officers and mortgage brokers.

LinkedIn is primarily a business networking platform focused on building professional relationships. Creating a LinkedIn personal profile and actively using the platform will allow you to connect with business partners and clients. LinkedIn is an effective platform for creating and promoting your brand and actively growing your network.

Tips for getting the most out of your LinkedIn profile:

- Treat your LinkedIn profile as a landing page for your services. Spend time crafting your about me & skills sections, using keywords relevant to your target audience.

- Connect with realtors and nurture professional relationships that can lead to referrals

- Write and share relevant posts that showcase your knowledge of the mortgage industry and provide value to your followers

As the world’s largest social media platform, Facebook offers a wealth of opportunities for mortgage professionals. While many people use this platform for connecting and sharing with family and friends, creating a strong Facebook presence for your mortgage business can help you develop relationships with an audience you may not usually reach using other marketing methods. According to Statista, Facebook remains the leading platform used by marketers globally (93%) with Instagram following closely behind (78%).

Tips for getting the most out of your Facebook profile:

- Post regularly and engage with your audience. Examples of posts include client testimonials, partner spotlights, and closing highlights

- Showcase your brand and personality. Customize your profile to give people a better idea of what it’s like to work with you

- Provide your contact information. Ensure you include a way for clients to get in touch with you. Fill out your “About” section with your phone number, email, or website

While it may not be the first platform you think of for business marketing, there are some significant advantages to having an Instagram business profile. Instagram is one of the fastest-growing social media platforms, and it’s also excellent for finding and connecting with realtors in your area, potentially leading to strong referral relationships. Since younger homebuyers often consider Instagram their platform of choice, it can also be a great way to connect with millennials, who are predicted to be the largest demographic of homebuyers in the coming years.

Tips for getting the most out of your Instagram profile:

- Take advantage of reels to engage your customers with captivating content

- Use Instagram stories to provide updates about your firm or share industry news

Twitter is another platform to help you reach a large pool of potential clients. It has a large number of users who have a desire for real-time information, allowing you to connect uniquely and position yourself as an industry expert. Using Twitter best practices will help you efficiently use the platform and make the most of your time there.

Tips for getting the most out of your Twitter profile:

- Research trending industry topics and use relevant hashtags to reach a wider audience

- Engage with your clients and industry partners by responding to and sharing their posts

3. SMS Texting Mortgage Marketing

What Is SMS Mortgage Marketing?

SMS is a form of marketing that uses text messages to reach customers, prospects, and referral partners. Texting is a conversational and naturally engaging way to communicate. And since the messages are sent directly to the recipient’s cell phone, SMS allows you to avoid overcrowded inboxes and reach people in a highly convenient way.

What Are the Benefits of SMS Mortgage Marketing?

Sending business communications through SMS text messaging is the best way to reach your contacts directly. While emails can easily get lost in the shuffle, SMS messages have a 98% open rate, allowing you to enjoy instant engagement with your contacts.

SMS is a powerful tool to add to your automated marketing strategy. Using text messaging, you’ll be able to get your message out quickly and efficiently and have the confidence of knowing that it’s delivered securely and reliably. SMS is also an excellent way to communicate with your team and referral partners, keeping everyone updated in real time.

How to Get Started with SMS Mortgage Marketing

Mortgage professionals have successfully used SMS to send document confirmations, loan process updates, and reminders. Jungo’s SMS text messaging platform integrates with your Jungo Mortgage CRM so that you can send messages with a single login. The system also makes it easy to send mass text messages and automated and scheduled text messages. It’s an excellent way to streamline your workflow so you can focus on closing instead of texting.

“Jungo’s SMS Text Messaging allows me to send out automated text messages that support my clients even if I don’t send them individually, and we keep the conversation going from there.” -Nathan Burch, LO from Vellum Mortgage

4. Video Mortgage Marketing

What Is Mortgage Video Marketing?

It’s an emotionally engaging way to connect with clients, prospects, and potential referral partners. This marketing strategy may involve posting videos on platforms like YouTube or embedding them into your website. You may include them in your mortgage social media posts and mortgage email templates.

What Are the Benefits of Mortgage Video Marketing?

Utilizing video marketing, specifically on channels such as YouTube, can be a great way to connect with an audience that prefers video content. Video is often more engaging and eye-catching than written forms of communication. Users are typically more likely to sit through a 2-minute-long video explanation versus reading that same amount of content in what would translate to a 10-minute article.

Creating value-packed videos is a highly effective inbound marketing strategy. Rather than pushing your message out, videos help draw people to your website and social media channels. When you share your knowledge, you grow your following and firmly position yourself as an industry expert. Since the format is so easy to consume, mortgage videos should consider brokers exploring inbound marketing for residential mortgages.

How to Get Started with Mortgage Video Marketing

Mortgage professionals looking to start video marketing can often benefit from establishing a presence on YouTube. Establishing a presence requires creating and maintaining a channel and consistently posting new videos over time. You’ll need to start brainstorming video ideas and set aside time to film and edit your videos. Examples of mortgage marketing videos to create include:

- Explainer Videos – educate your clients on the borrowing process, give process updates, and provide helpful tips

- Promotional Videos – promote your services and upcoming events

- Customer Testimonials – highlight past or current clients that are happy with your services

- Expert Interviews – interview other professionals in real estate or related industries to bolster your firm’s reputation as an authoritative resource

You’ll also need to promote your videos and periodically analyze your results.

“The secret to being successful on YouTube is determining who your ideal prospect is, researching the questions and problems they are trying to solve, and making content that addresses those questions in a way that is not even remotely self-promotional,” Karin Carr, CEO of Karin Carr Coaching

Suppose you’re not ready to commit to YouTube. In that case, you can also take advantage of video marketing by using video emails to send personalized introductory videos, status updates, meeting follow-ups, and more. Integrating videos and their transcripts into your website can also improve your SEO, helping your site rank higher and increasing the chances you’ll be found through organic searches.

Bottom Line

You’ve learned all there is to know about how mortgage brokers and loan officers can use digital marketing channels to win new clients, provide value to existing clients, and nurture repeat business with past clients. Let’s recap the main takeaways from this chapter:

- Digital mortgage marketing encompasses a mortgage business’s promotional efforts to connect with prospects through digital channels. Digital channels include your mortgage business website, blog content, email marketing, SMS marketing, and social media.

- Before you develop your digital mortgage marketing strategy, you must identify your target audience and understand their needs and behaviors. With this knowledge, you can choose the digital marketing channels that will best support your marketing efforts.

- The top digital marketing channels mortgage professionals use include email marketing, social media marketing, SMS text marketing, and video marketing.

- Many digital marketing activities can be automated with the right mortgage marketing automation tools so you can dedicate more of your time to delivering a quality client experience.

In Chapter 4, we will cover Search Engine Optimization (SEO) and how you can leverage your online presence to find clients that are already looking for your services.

Previous

Chapter 2

Loan Officer Marketing Plan Template

Next

Chapter 4

Loan Officer & Mortgage Broker SEO Strategies