J.D. Power’s 2019 U.S. Primary Mortgage Customer Satisfaction Study was released recently, and the results were…mixed.

There are a few major observations that can be made about the study, and some great chances to learn from the findings. Here’s what we saw in the numbers…

There are a few major observations that can be made about the study, and some great chances to learn from the findings. Here’s what we saw in the numbers…

The Finding: Loan Volume Goes Up, Customer Satisfaction Goes Down

Although overall mortgage customer satisfaction in 2019 was up (14 points higher on a 1,000 point scale), this was not a steady improvement throughout the entire year. In Q2, as mortgage originators saw a huge amount of growth in loans, mortgage customer satisfaction dropped.

In the first quarter of 2019, borrower satisfaction was 869 out of 1,000 points. By the second quarter, however, it fell to 853. This drop came at the same time as the 54% jump in mortgage originations between Q1 and Q2.

What Does That Mean For You?

For many loan officers, 2019 was their best year yet for originations. However, we think it’s a serious red flag if mortgage customer satisfaction suffers during loan booms. We get it though. It’s tough to provide incredible customer service when your pipeline is extremely full.

Being able to provide excellent service to all of your borrowers, no matter how many loans you have in your pipeline is one of the keys to being an incredible loan officer. This may mean that it’s time to hire a LOA to handle some of your backend processes. Or perhaps, you should invest in a CRM to automate some of your tasks.

However you choose to approach your workflows, this is the time to streamline your processes. Then, you’ll have more time to delight your customers with incredible support.

The Finding: Customers Love Digital Tools

We’ve talked quite a bit on the Jungo blog about excellent communication with your borrowers, and the J.D. Power study highlighted this too. The study found that when borrowers have access to (and use!) an online portal, overall satisfaction is an average of 140 points higher. Clearly, being able to check on your loan status, in real time, and on your schedule, is a huge indicator of a great mortgage experience.

What Does That Mean For You?

Well, if you have the ability to offer a loan portal to your customers, do it! However, if that’s not something that you can provide, there are alternatives.

One way is to send consistent loan status updates, as soon as there is a change in a loan. Automating your loan status updates is the easiest way to do this. With Jungo, you can set a workflow to take care of this for you. As soon as a borrower’s loan status changes, an email update and/or text message are sent. This will keep your customer up to date, and it will all be taken care of without any work on your part.

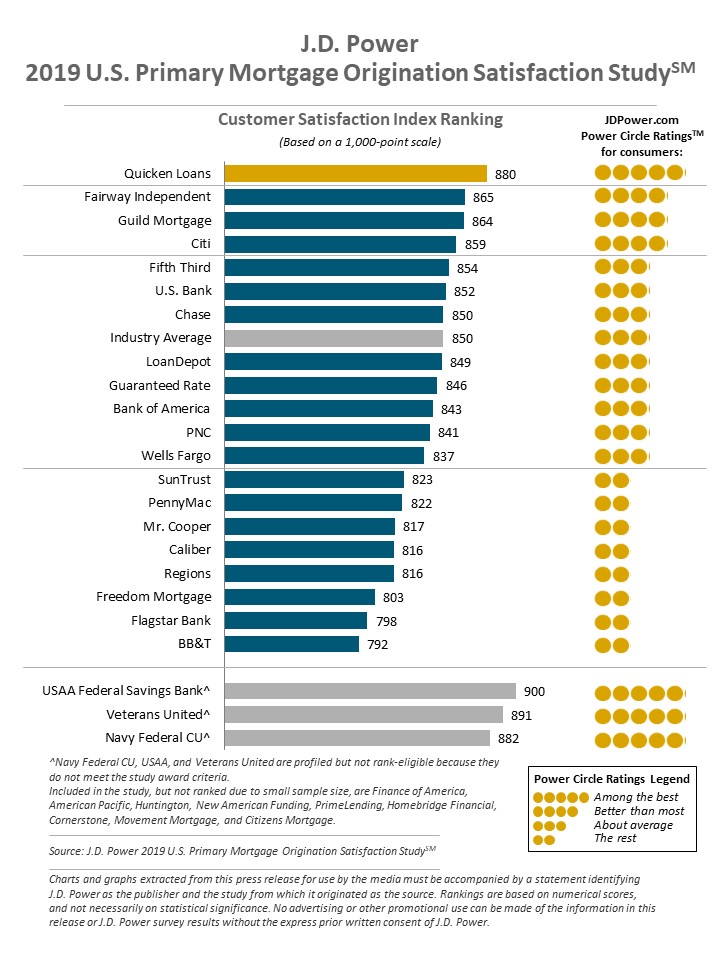

The Finding: The Front of the Pack Remains the Same

For the 10th year in a row, Quicken Loans earned the #1 spot for mortgage customer satisfaction. Their satisfaction score was 880, compared to the overall 2019 average of 850.

Not far behind, Fairway Independent Mortgage came in #2, with a score of 865. And in the #3 spot is Guild Mortgage with a score of 864. 2018’s top three was the exact same line-up of originators, pointing to some consistency among these companies.

What Does That Mean For You?

If you work at any of these companies, then congratulations! Your company is doing customer service right–keep focusing on providing your borrowers with an amazing experience, and you’ll keep climbing the charts.

But, what if you don’t work at one of these companies? There are still ways to give your clients an awesome loan experience. The J.D. Power study is based on four factors: application and approval, communication, loan closing, and loan offerings. Consider how to make your processes excellent in every one of those areas. We’ve already discussed communication and loan status updates, but how about integrating digital applications and document uploading services? How about providing your borrowers with amazing loan pricing options? Or, find a mortgage niche, and offer incredible knowledge to your customers!

However you choose to increase your mortgage customer satisfaction, just remember: you don’t need to be at a huge company to make an impact.

Bottom Line

The recent J.D. Power 2019 U.S. Primary Mortgage Origination Satisfaction Study revealed some very interesting findings about the mortgage industry. However, we think the most interesting finding wasn’t in the numbers, but instead in what those numbers say about the industry as a whole.

Clearly, borrowers still care about amazing communication from their loan officer. Additionally, it’s critical to focus on providing top-of-the-line customer service, even when you have more loans than you know what to do with. These are the foundational elements of being a loan officer that never change.