Age is just a number. But when it comes to marketing mortgages to millennials, age can mean everything. If you’ve ever tracked the demographics of your borrowers, you may have noticed an interesting phenomenon. Your loan pipeline was probably heavily populated by the younger generation which is why you’ll need to master marketing mortgages to millennials.

In fact, Millennials (those between 23-38), accounted for nearly half of all home purchases in 2018. That’s a sizable chunk of your potential borrowers. Therefore, it’s important to consider one of their most defining characteristics: tech savvy.

Whether you’re an early adopter of technology, or a bit more traditional, one fact is the same. Marketing mortgages to millennials, aka “digital natives”, doesn’t need to be a daunting task. Start by considering how to reach a market segment in which 99% start their home search online. Then, create a strategy customized to their unique needs.

Remember, half of your business comes from referrals. Therefore, you need to start integrating digital practices into attracting new clients and during the loan process.

If you are able to provide a seamless experience during and after the loan process with digital tools, your younger clients will tell their millennial friends about their great experience.

How To: Marketing Mortgages to Millennials

Create a Website (Or Update the One You Already Have)

Chances are, you already have a website. However, if it’s missing current information or looks dated, it may be hurting you more than it helps. If this is the case, improve the first thing that many potential borrowers see about you.

If you want to create your own website, check out companies like WordPress, Squarespace, or Wix, which allow you to create custom made websites with the help of easy-to-use templates.

Image courtesy of Squarespace.

When choosing a template, go for one that is simple and clean so you can focus on the content, not the design. Using a template is a “must” if you don’t have a web designer. A template will keep the fonts and styling consistent throughout the site. In addition, most templates are already mobile optimized, which is a critical part of a successful website.

Many website design companies allow you to create and host a website for free, but you probably will need to invest in your own domain name.

For help on creating or updating your website, check out this helpful resource.

Get on Facebook or Instagram

One of the easiest ways to get started with digital marketing is through social media. If you don’t already have a professional social media status, it’s not too late to start!

Start off by creating a profile that includes your business and contact information, and of course, your new website info. Then, add a brief bio about what makes you stand out in the industry.

The next step is to post some great content! Don’t worry if you don’t have too much to post at first–you can start slow and go from there.

If you are just getting started on social media, here are three ideas you can post about each week:

1. Loan Scenario Recap

Did you just close an interesting loan? Share it! This will help other prospective borrowers see the work you can do.

2. Fact of the Week

You’re the expert, so you should share valuable information about the mortgage industry. Think about the things that your borrowers didn’t know before they talked to you. For example, discuss how you don’t need 20% down to buy a house.

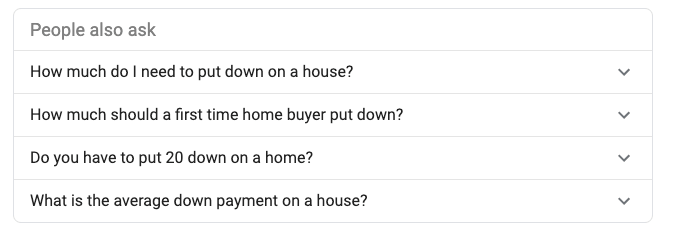

3. Answer a Commonly Asked Question

Similar to a fact of the week, you can use Google to find questions similar to common ones you hear, and then answer them on your social media.

With social media, consistency and frequency is key. So, having a set schedule and sticking to it will help you grow your followers organically.

Once you have a set schedule, using a social publishing tool like Buffer can help you plan out content in advance.

After you get your organic posting down, consider paying for Facebook or Instagram ads, in which you pay a small amount to promote your content. You can target your ads to demographics you’d like to reach, and invest more money into the ads that gain the most traction.

Marketing Mortgages to Millennials: Market to Specific Demographics in a Geographic Area

Traditional marketing techniques, like paying for thousands of door hangers for an entire geographic area, may be the last thing on your mind when you are considering your digital marketing strategy. However, you should be thinking creatively about how you use technology to market!

One such way is to use highly detailed demographic information (thanks Big Data!) to segment your markets. You could choose to send direct mailers to only younger generations living in a certain geographic area, and customize your marketing accordingly.

Although direct mailers may feel like the furthest thing from digital marketing, or the best way to market mortgages to millennials, including digital elements is a handy way to integrate the two. Try adding a scannable QR code to a door hanger that when scanned on a smartphone, shows them a video of you chatting about your business.

We like this company for creating a QR code.

Don’t forget to include your social media handles and website URL!

Once You Have a Lead

Send Digital Pricing Options

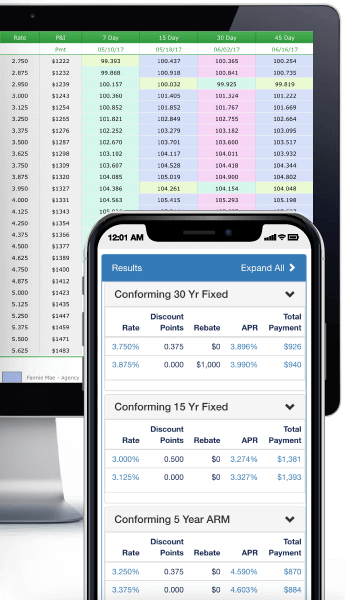

Loan Pricing Engines, like Optimal Blue or Lender Price, allow you to instantly calculate a borrower’s loan pricing options. Plus, you can send potential borrowers interactive calculators. These allow them to see their different mortgage options, and how much they could expect their payments to be.

Image courtesy of Optimal Blue.

Once The Borrower Has Started Their Loan Application

Offer SMS Updates

78% of US Consumers say that receiving text messages from businesses is the fastest and best way to reach them. So, the generations of digital natives will love your ability to communicate with them via texting. Plus, this is especially helpful once they have submitted their loan application.

SMS texting through Jungo is a great way to get started with texting for your business. Learn more about CRM Integrated Business Texting, here.

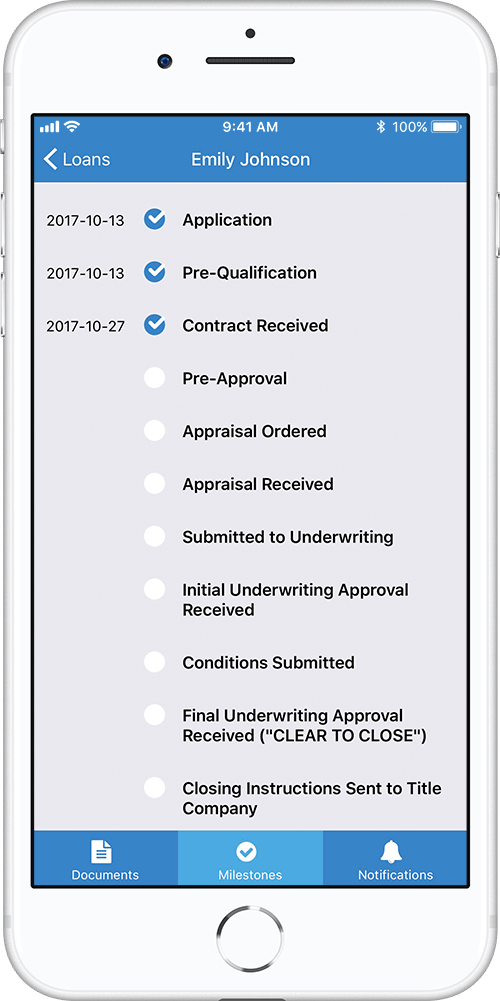

Use a Digital Document Upload Services

One of the least efficient steps in the loan process is often document submissions. For digitally fluent borrowers, a game changing option is providing a digital document upload service. For example, companies like Floify provide a borrower facing portal. Here, clients can scan and upload the required documents directly from their smartphone.

Image courtesy of Floify.

Even better for you, many digital document upload services also offer automated document needs lists messages. That way, you can spend less time thinking about which documents your borrowers haven’t submitted. So, this will give you more time to explore the wide world of digital marketing.