We know how challenging it can be to expand your client database and gain more referrals. But, a Facebook presence can help with that! With more than two billion people on Facebook, your potential audience is huge.

A strong Facebook presence gives loan officers the ability to connect with people who they may not normally reach. Learn how to scale your business with a Facebook presence and get started today by reading our suggestions below!

Why should you care about a Facebook presence?

A Facebook presence, specifically a business page on Facebook, gives you a way to communicate directly with your ideal target audience. Think of it as an ongoing focus group. Your prospective clients who follow you will be aware of your work as a loan officer, and when they’re ready for a mortgage, they know where to find you.

By providing your followers with useful information, you can also build trust. This will help you engage with clients like never before and build even more meaningful relationships!

Setting up a Facebook page is an easy, free way to develop an online presence for your business. On your business page, people discover your brand and learn about your offerings. Your mortgage business can connect and communicate with borrowers anytime, anywhere.

Discover your brand

Determine the audiences you want to reach through your data and insights. Who are your borrowers? With a Facebook presence, you can deliver your message to the right people at the right time. So, it’s important to post content that engages your customers and inspires them to take action.

Make sure to use your own pictures, videos, blog posts, and other content to engage potential clients. People are interested in learning what makes your brand unique. So, consumers are likely to trust mortgage professionals who use original content. This could factor into their decision when selecting a mortgage loan originator. It’s your goal to make them want to choose you!

Show your personality

Loan officers often offer very similar rates and loan programs. So, how can you stand out? Share your personality with your Facebook presence! This helps clients understand and trust you over other competition.

What makes you a human being? After all, there’s a lot more to you than being a loan officer. Share that! Examples include: being a pet lover or currently training for a marathon. Put your own spin on your mortgage business profile by sharing who you are, and why borrowers should choose you.

Customize your “about” section

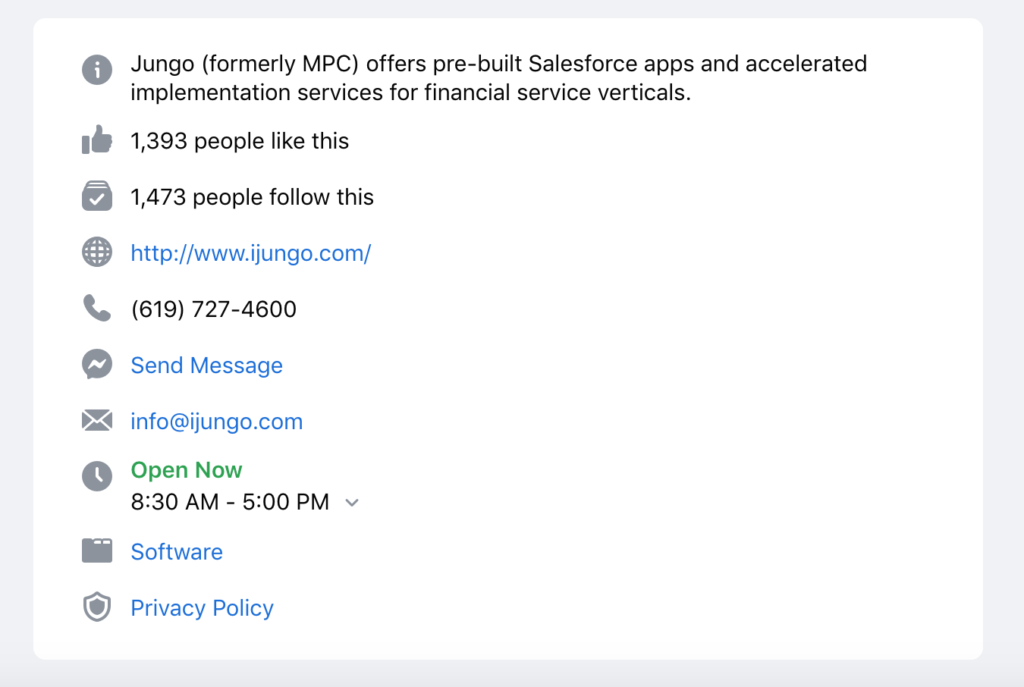

The “about” section on Facebook is something prospective clients will look at to get to know you. To access this page, go to “about” and the “more info” section to edit it. When people google your business, your Facebook page will land at the top of the results. It is important that the “about” section contains accurate information about your company.

Use your profile photo and cover photo/video

Also, make sure that your profile photo and cover photo/video reflect you and your business well. These drive action on your page since they are a source of loan officer advertising. Examples for cover photos/videos include: a brand story video, promoting a local event, promoting a realtor’s listing, or sharing places around your local area. Keep this information specific, recognizable, and up-to-date!

Engage with people

Connecting with clients online may seem challenging, but it is easier than you think. So, try to avoid being too salesy in your Facebook presence. Engage with potential clients and current clients in a meaningful way.

Ask for people’s recommendations, opinions, and guidance to start genuine conversations. Your mortgage Facebook presence should not be all about business advances. Keep it light and friendly, and the loans will naturally come in.

Tag people

Tagging other people in your Facebook posts is a great way to spread your content. When you tag people, all of the friends of the people tagged will see the post too. This is one way to increase a posts’ reach. So, make sure to connect with referral partners and clients as friends on Facebook so you have the ability to tag them!

Respond to messages

Messages and comments on Facebook could be potential leads. If someone is interested in getting a loan, they may reach out to you on Facebook. This is a casual first step in building that client-to-borrower relationship. So, responding promptly is a sign of good customer service. A consistent Facebook presence will also earn you a rating of “very responsive to messages.” This is another great way to show potential clients the type of service they could expect from you.

Add customer chat

On your Facebook page, you can turn on a feature to talk directly with page visitors. When people access your page, a Facebook Messenger pop-up box will appear. This is an interactive chat feature. Also, it includes questions you can answer beforehand or allows for live messaging with prospective clients. Communication is key to grow your business. Learn how to add this feature to your Facebook page here.

Post Regularly

If you do not post often on Facebook, your audience may forget that your business exists. However, if you are posting too often, you could overwhelm them and clog their feed. Find that sweet spot with your Facebook presence to keep your message top of mind. Not sure where to start? Here are a few easy post ideas:

Successful loans closed

Post about your most recent closed loans and celebrate your borrowers’ milestones with them. They are now officially homeowners! Even if you can’t be at the closing, ask your partner to snap the photo. Or, post a photo of their beautiful new home that you helped get them the keys for. There’s no happier client than one who just closed on their dream home!

Client testimonials

Testimonials from real clients strengthen your brand, build trust with potential clients, and just feel good. So, if you receive a great review on Yelp or Google, post it to social media. And if a happy client emails you, ask them if you can share their experience with your audience.

Partner spotlights

Similar to an employee spotlight, partner spotlights highlight your current partners. These posts are great for introducing partners who you work with and explaining what they do. Also, your partners will appreciate the exposure, and your followers will love the recommendations for local experts that they can trust.

Interesting videos

Video does extremely well on Facebook. Just a couple of videos a month can really boost engagement on your page. Once you feel comfortable filming video, try a Facebook Live, which often does even better than a standard video. Share tips about the market or helpful information about earning a mortgage!

Blog posts

Use your online marketing efforts and showcase your blog! You should always share your company’s blog posts on all social media accounts for cross-promotion.

Jungo’s The Mortgage Update blog posts are another great resource to share. Enhance your Facebook presence and educate your borrowers with tips and tricks found in the articles! Also, if articles from other sources are industry-related, don’t be afraid to share those as well for more engagement.

Bottom Line

Having a Facebook page for your mortgage business is a great step toward getting more leads. Make the most of your Facebook presence by following these tips for successful mortgage marketing. These will help any loan officer gain a wider reach and connect with clients. Engage with your customers and inspire them to take action!