Jungo is proud to announce the Jungo + LendingPad LOS Sync! LendingPad, a cloud-based loan origination system designed by lending professionals, is better than ever when paired with a mortgage-optimized CRM. With the Jungo + LendingPad LOS Sync, loan originators can work even more efficiently to serve their clients.

This LOS Sync features increased connectivity and security, customizable field mapping, and realtor and co-borrower contact creation.

A complete sync between LOS and CRM allows for powerful automations and insight into the mortgage process. Jungo receives current loan file information, which ensures that data is always up-to-date, from lead, to application, to close, and beyond. This simplifies the mortgage process and prevents double data entry, allowing mortgage professionals to focus on their clients’ specific needs.

Mortgage LOS Integration With CRM

A Mortgage Loan Origination Software (LOS) is one of the many critical tools in a Loan Officer’s toolbox. So, a good LOS is the foundation of an efficient and profitable relationship between a loan officer and a borrower.

What is a Mortgage LOS?

Loan Origination Software (LOS) is a platform for mortgage originators to manage the different steps of the loan servicing cycle. For example, loan officers can store data, process loan applications, gain credit approval, and automate underwriting through a LOS.

What is a CRM?

If you are looking for a complete client communication platform, you should consider a Customer Relationship Management (CRM) platform. Jungo’s mortgage-specific CRM offers full automation of your client, partner, and lead communication, and loan pipeline management.

A CRM gives loan officers more flexibility in their work, by freeing them up to focus on the high-value tasks that make them more money. Also, a great CRM helps ensure that your customers are getting the best service possible at all times.

Why Do You Need a CRM?

All employees have access to current client and loan data and other important information within a CRM. So, that way, they have everything they need to provide a stellar customer experience. After all, when your team is working from multiple platforms that don’t talk to each other, it is nearly impossible to work efficiently!

With a mortgage-optimized CRM, you can also manage schedules and tasks, perform data analysis, generate data-driven reports, and organize important files in one secure location.

So, avoid letting an opportunity slip through the tasks with a CRM that is always earning you business, even when you’re away from your desk.

What is a Software Integration?

A software integration is a connection between two of your mortgage tools. Basically, it’s a way to make your systems “talk” to each other. There are different types of integrations, like an LOS integration, but the simple goal of all of them is to make your life easier.

Integrating your software platforms will help you truly get your money’s worth from your investment by freeing you up to accomplish more everyday.

Why Do You Need Your Mortgage LOS and CRM Integrated?

Integrating your LOS and CRM is key to skyrocketing your success. These are two of the most powerful tools that you have at your disposal, and if they aren’t integrated, you’re leaving money on the table.

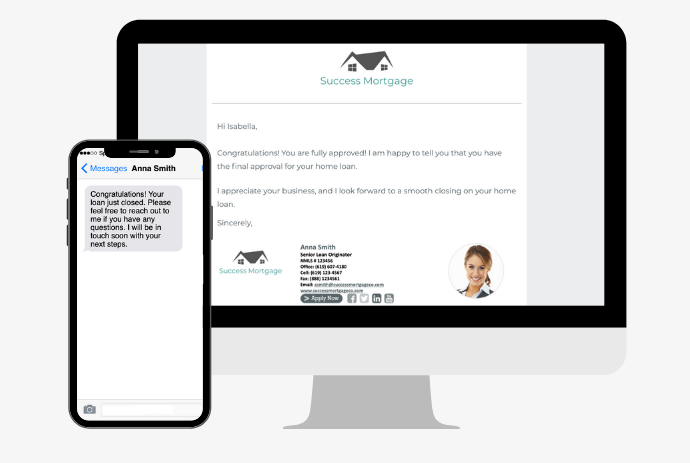

An LOS integration with your CRM means that when loan data is updated in your LendingPad account, it syncs automatically to your Jungo account. For example, if a borrower submits their loan application through your LOS, your CRM will update to reflect this new information. From there, many different action items can occur in your CRM. For example, automated notifications could be triggered. This can be for your borrower, co-borrower, and referral partner updating them on the status of their loan with you!

Jungo + LendingPad LOS Sync

Jungo’s Mortgage CRM features a complete sync with the most popular mortgage LOS platforms, now including LendingPad. This complete LOS integration will save you time and effort. Plus, you’ll be able to avoid the headaches and frustrations of double data entry and human error.

The Jungo + LendingPad LOS Sync Allows Loan Originators To:

- Minimize sync errors with zero downtime after password or version updates and easily accessible error logs.

- Easily adjust mappings and milestone fields.

- Gain access to multiple pairing methods for syncing between LendingPad and Jungo.

- Access greater consistency and security with sync improvements.

- Eliminate the need for double data entry due to data syncs every 15 minutes.

But best of all, having your Jungo account and LendingPad integration means that you can actually use the data you’ve worked so hard to gather. Your data won’t be in a silo. It’ll be in informative reports and dashboards, and ready for you to leverage in the form of automated workflows, marketing, and streamlined team processes.

How Could the LendingPad LOS Sync Work For You?

With automated loan process updates, as soon as a loan moves to a new stage, updates are sent to your borrower and any relevant partners. With the Jungo LOS Sync, these updates can be automated! So, you can focus on high-income opportunities like connecting with new clients and partners. Plus, your borrowers love the quick and consistent updates on the status of their mortgage.

Specific Features

There are so many ways that the LendingPad LOS Sync can work for you, once it pushes to Jungo. For example, there are automated workflows that you can access. Place your contacts on a drip marketing email campaign with Jungo’s marketing platform. This comes loaded with over 400 pre-build email templates that you can send out right away, or customize to perfectly fit your branding and message.

Or, automatically order a closing gift through Jungo’s Concierge Program as soon as a loan closes. With one click in your Jungo account, you can send up to three years worth of branded cards and gifts straight to your customers’ door. Then, earn mortgage referrals and repeat business from your client database with these thoughtful and personalized packages.

Bottom Line

A fully integrated CRM is one of the most effective ways for you to invest in your business. Making your LOS and loan pipeline data work for you will power your client communication. Plus, you’ll have more time and energy to tackle your to-do list. Jungo and LendingPad will be handling all of the automated backend processes, which will free you up to focus on the part of your job that matters: relationships.