As a loan officer, it is important to invest in your business and continue to grow with your practices. This can look like investing time and money in your business, adopting a CRM, and allowing your business processes to work for you.

After all, you need to level up your business and invest more to continue to grow.

Keep reading to learn how to best invest in your business and your future success.

Grow Your Business

Sometimes, it may make sense to spend money to make more money. When you intelligently invest in your business, you can then reinvest your revenue again.

Whether you invest in products to help your business run smoothly, outsource tasks, or streamline your processes, spending the time and money is very often worth it.

After all, you can’t expect to be able to run a business all by yourself. There are programs and services out there that save you time (and stress) so that you can focus on growing and making more money.

Invest in Your Business

Once you start to invest in your business, you really begin to take the processes more seriously. Since no one wants to waste money, pouring into your business will lead you to work smarter in order to close more loans and earn more leads.

Invest in Educating Yourself

As loan officers, there are so many different hats that you wear on a daily basis. Depending on your team structure, you may work with clients at every step of the loan process. So, it is necessary to continuously invest in yourself and implement new processes. Then, your daily tasks and routine will be less daunting, and you can earn more business.

One way to focus on growth is to pursue mortgage coaching programs. Top producers recommend these programs to loan originators in the industry as key to their success.

Re-Evaluate Business Expenses

Another way to invest in your business is to discover ways to make money in the long run. So, consider re-evaluating your business expenses and see how this affects your taxes. After all, purchasing a CRM system could serve as a tax break as it is a business expense that saves you money over time.

The return on investment when using a CRM is well-worth it as you can easily save thousands of dollars that may be spent annually on an assistant. On average, CRM systems return almost $9 for every $1 invested. So, companies who utilize a CRM see a substantial ROI compared to those that do not.

Save On Taxes

Tax season may not be your favorite time of year. But, there are ways to save money on your taxes that are worth considering. The IRS offers tax deductions for loan officers each year. Not only do many deductions reduce your income tax, they also reduce your income subject to self-employment tax.

Many taxes you pay in the course of your mortgage business are deductible as business expenses. You pay other taxes separately and can deduct them as taxes on your business return. These include state tax on gross business income, federal and state payroll taxes, personal property tax on business assets. Plus, real estate taxes on business property. You cannot deduct federal income tax.

Increase Lead Conversions

A critical part of growing your business revenue is turning leads into customers. A small increase in your conversion rate can noticeably increase your revenue. So, committing to a CRM can impact your direct lead conversion processes. This speeds up your lead contact strategy and nurtures them all the way to application.

Your lead response time can improve with automations. After all, the more quickly you reach out to a hot lead, the greater your chances of conversion. Studies show that connecting with a lead within 5 minutes is 21 times more effective than after 30 minutes.

Action Automations

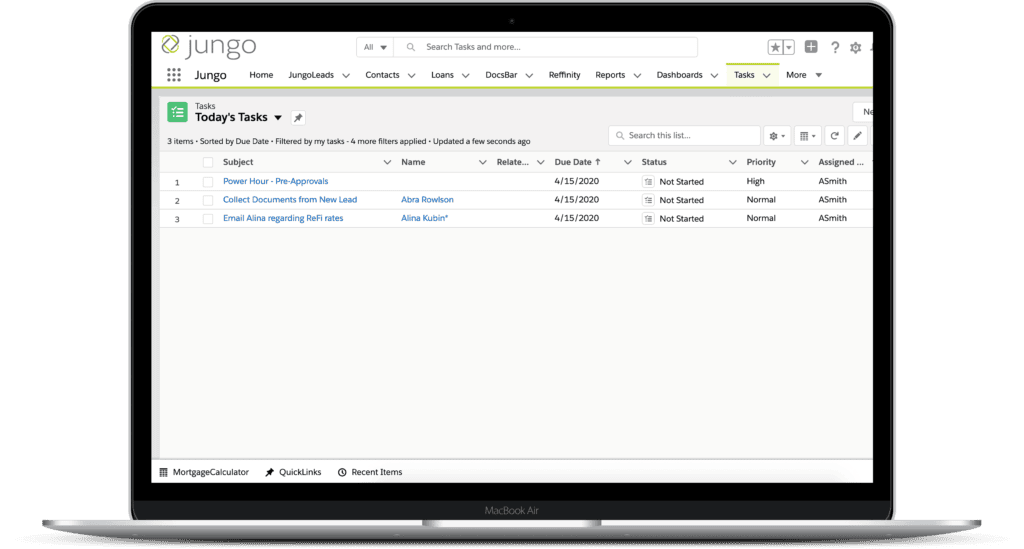

Action mortgage automations are any workflow that results in an action item for the user. For example, when a new lead comes in and a task is set to call them right away, the action is to call someone.

Action items organize your day. They prioritize what is important to make sure you are reaching the right people quickly. Your task list and calendar should fill with these high priority items.

How could you use action automations in Jungo?

1. When a new lead enters your system: a workflow triggers, creating a follow-up task to call this new lead once they enter into Jungo. Then, the new lead is automatically sent a prospecting email welcoming them.

2. During the loan process: tasks are made that remind you to follow up with the borrower and your partners with loan status updates.

3. If a lead needs to improve their credit: the “Credit Impaired” workflow creates a task for the loan officer to follow-up with the client 60 days later

4. When a loan closes: a task is made to remind you to order a closing gift for your client.

Save Time

Action workflows are important for setting up each day to be the most productive it can be! Plus, mortgage automations help you remember to complete all the little tasks that come up throughout the day.

All types of mortgage automations can make your business run smoothly, and save you time. They give you the freedom to complete other tasks while marketing and follow-ups go out behind-the-scenes. Matching mortgage automations to your processes and goals is a huge way to invest in your business.

CRM Task Management

Imagine you are on the phone with a new customer. They are ready to submit a mortgage application, and want more information about interest rates. You hang up the phone, and immediately have multiple action items you need to accomplish.

Send them their application. Then, place them on a marketing campaign, compile information about interest rates, and remember to call them to check-in next week.

Also, don’t forget to call their realtor and thank them for the referral. Even if your assistant helps you with any of these tasks, you need to remember to loop them into the conversation.

How are you supposed to remember all of these to-dos?

A CRM, or Customer Relationship Management system, is a tool designed to help you grow your pipeline. And, close more loans as fast as possible.

Creating Tasks

The first thing you need is to create a task.

It’s best to create tasks as soon as you think of them. For example, after you speak with a lead about a ReFi, create a task to email them the next day with information about refinances. By doing this, you won’t forget to create the task. When you login into your Jungo CRM the next morning, you’ll see this task ready for you to tackle.

Logging Calls and Interactions

Top producing loan officers know to keep a log of every call and interaction that you have with a contact. This is key to building a strong relationship.

If you note details from your conversations when you speak to them down the road, you impress them with your memory! Your secret is that it was actually your Jungo CRM doing the remembering, not you.

Logging a call is simple in Jungo–just remember to always write as many details as possible. That way, if you or a team member look up the contact down the road, you’ll know exactly where you left off with them.

Scheduling Follow-Up Tasks

After you log a call, you’ll probably have follow-up tasks associated with the conversation. As we discussed, task management is simple if you handle things as soon as they come up. Therefore, once you log a call or an interaction, it’s critical that you immediately create follow-up tasks.

The great thing about follow-up tasks is that they can help you remember actions items that are due. Either way, even if you’ve completely forgotten, Jungo hasn’t. Your CRM will notify you on the day your tasks as due, so you can check them off.

Checking Off Your To-Do List

As we mentioned, you’ll be the most efficient if you tackle your to-do list first thing in the morning. That way, you are free later in the day for the phone calls and meetings that will inevitably arise.

It is worth it to have a great task management system in place in your CRM. That way, you can relax knowing that your to-do list will be ready and waiting for you as soon as you login.

Check tasks off as you go, or pull up the Kanban task view in your Jungo account and start moving tasks to complete. However you choose to knock your to-dos out, you are equipped to finish your tasks more efficiently. This is a productive way to invest in your business.

Bottom Line

Purchasing a CRM is one of the most effective ways for you to invest in your business. Making your data work for you will power your client communication. Plus, you’ll have more time and energy to tackle your to-do list and save more money. Your software will be handling all of the automated backend processes.