We’re going to make a wild assumption here. You probably don’t like cold calling mortgage leads. Did we get that right?

Even if you’re one of the special few who enjoys calling a cold lead, there are strategies for marketing to cold(er) leads that will yield better conversions with less wasted time.

What is a Cold Call?

A cold call is calling someone you haven’t met before and/or is not familiar with who you are. If you call someone who did not explicitly ask YOU to reach out to them, that’s also a cold call.

Cold calls have a bad reputation, since they can be intrusive, scammy, or just plain unwelcome. But phone calls are still an effective way to connecting with prospective home buyers.

(Cold) Lead Providers

First, you need to have a number to call. Duh! Chances are, you probably will purchase lead’s contact information from a lead provider.

Buying mortgage leads is a popular option among mortgage loan officers, especially as more potential borrowers turn to the internet for their home search.

When an interested buyer submits his or her information on a website such as Zillow, that buyer indicates that they may be interested in a mortgage or refinance.

Then, Zillow (or whatever company the data was submitted to), will then turn around and sell that lead to mortgage loan officers, like you. This is how you’ll generate your list of leads to call.

But should you wait until you have a list of leads to call? No! If you have the option to, choose to receive leads as close to the time of their interest submission. If you wait 24 hours or even days until you have enough leads to bulk call, you’ll miss out on the best opportunity you have to make contact with that lead. If you call a lead almost immediately after they’ve submitted a request, your call will not feel as cold.

Cold Calling Mortgage Leads

Okay, now that you have your leads, it’s time to get down to it and actually call. Having call reluctance is to be expected, but it’s important to push past this. Here’s how to get started.

Research Your Leads

The first step to a successful cold phone call is to do your research. Thanks to today’s data-driven world, you can find out a lot about a so-called “cold” lead. After all, there’s nothing worse than going into a cold call completely blind!

The first step is to look the lead up in your CRM. This will help you check if they have engaged with you at all, whether via phone, email, or in person. Next, look them up online. Don’t spend too much time on this step because it can develop into a rabbit hole. However, if you happen to find the lead’s LinkedIn, website, or public social media accounts, it’s a great way to get a feel for them. However, don’t spend too much time on the research step. What’s most important is to make sure you haven’t spoken to them before and then call them quickly.

Decide What You Want to Say (Before You Call)

This will vary depending on your audience, but it’s important to decide ahead of time what you would like to say. There’s nothing worse than realizing that the person that’s calling you has no idea what they want to say to you.

This call is about starting a conversation so avoid sounding like you’re reading a script. Developing an outline ahead of time will help you remember what to say but execute naturally.

When you write your outline, keep in mind your goal is to get the lead to the next step. Most likely, the lead will not commit to a mortgage with you on the first phone call. Instead, your goal is to get them more familiar with you and what you could offer them.

Offer Value

The most important thing to think about before picking up the phone is why someone who’s never heard of you before should listen to you. One way to approach this is to consider their pain and find out how to answer the questions they probably have. For instance, if the lead is a first time home buyer, ask them if they have any questions about the mortgage process that you could answer. Tell them you’d be happy to explain any part of the mortgage process that might be intimidating to them. Or, if they’re interested in a refinance, tell them what you know about rates right now and if you think it’s the best time to refinance a home. Being honest and genuine will get you a lot of credibility.

Think Up A Strong Opener

You have about 10 seconds to snag someone’s attention in a call, and save yourself from being hung up on. Because of this, you need to come up with a reason that your cold lead will stay on the phone. Just remember: focus on your lead, and try to fulfill their needs. Also, remember, the closer you call the lead to the time they submitted interest, the more relevant you are.

Here’s a sample cold call script to use as an outline:

“Hi First Name,

I saw you were looking at [specify what they were looking at: mortgage rates, refinance rates] on [Provider: Zillow, LendingTree]. I am a preferred partner with [Provider] and help many [their speciality if specified: first time home buyers, veterans, etc.] get mortgage financing at competitive rates. I’m just reaching out to see if there is anything I can help you with?”

If response is “Nothing right now”:

“Completely understood. What I’m going to do then, is send you a quick email with my contact information so if down the road you have any questions at all, you’ll have a resource.”

Then, send an email immediately.

If response is “I’m just looking”:

“Absolutely! What I’m going to do then, is send you a quick email with my contact information so if down the road you have any questions at all, you’ll have a resource. I can also send you some information other [whatever they are: first time home buyers, veterans, etc.] have found helpful. Would that be of interest to you?”

Then, send a follow-up email immediately and put them on a relevant drip marketing campaign.

Using Jungo for Cold Calling Mortgage Leads

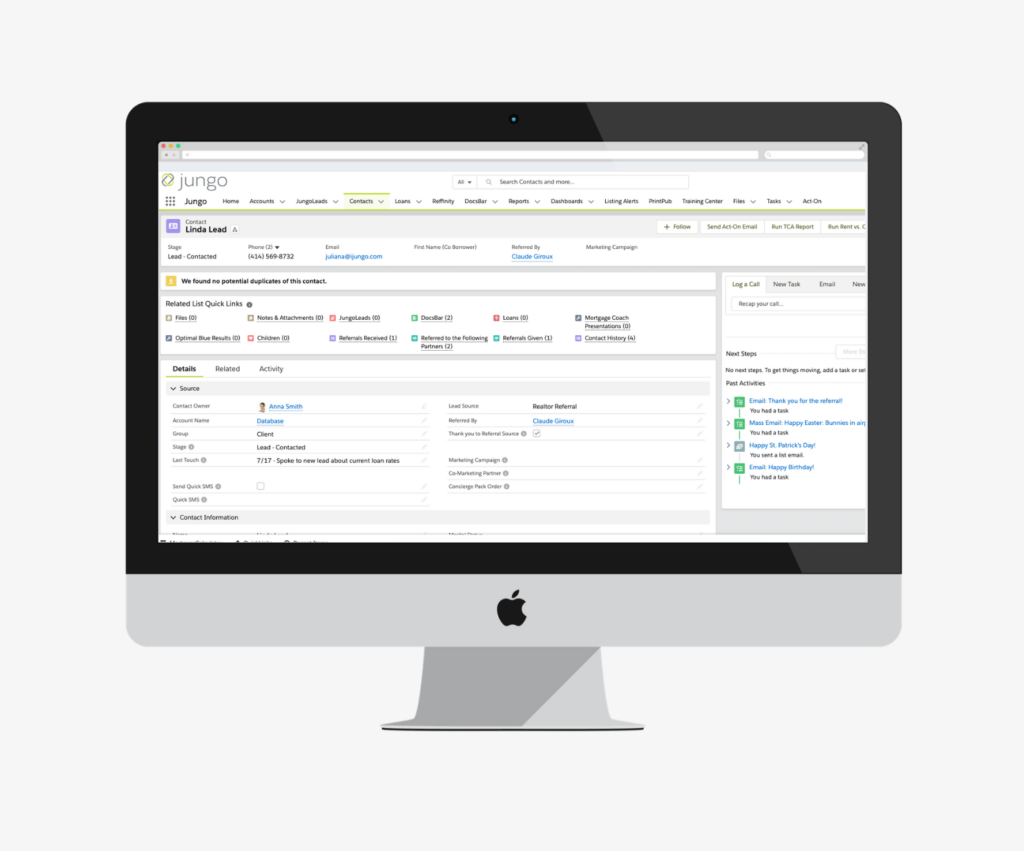

If you want a more streamlined approach, utilize a CRM with a lead provider integration, like Jungo with Lead Capture which pushes lead data from lead providers such as Zillow, Trulia, LendingTree, and Informa Research Services directly into Jungo. No need for double data entry. Calling leads is just a click away in Jungo.

Then, you can note any relevant information on the lead’s contact page, and indicate if you should follow-up. Lastly, send a quick recap email, right from your Jungo account. And with Jungo’s marketing email templates, you can create a custom follow-up message that you can easily send out.

Why Should You Use Jungo for Marketing to Cold Leads?

In addition to saving you time and minimizing double data entry, using Jungo to assist in your cold calling mortgage leads will also improve your conversion rates. Leads won’t slip through the cracks either, because you can set follow-up tasks for you or your assistant.

For example, imagine that you cold call a new lead, who says that they are not quite ready to refinance their home, but that they would love more information in about 3 months. How are you going to remember to reach out to them. In Jungo, all you have to do is set a task for yourself, and your CRM will remind you to handle the task in 3 months. In the meantime, you can put them on a drip marketing campaign so when they are ready to buy, they’ll remember who you are.

Bottom Line

Cold calling mortgage leads sounds like an intimidating process, but it doesn’t have to be with a little planning and preparation Just know, sometimes you’ll receive less than positive responses, and that’s ok. Keep practicing your value proposition, and remember that you’ll hear a lot more “No” than “Yes.”

That doesn’t mean that you should give up though. Cold calling mortgage leads can provide many valuable borrowers to you.